How we manage ESG risk | Policies and reporting - NAB

How we manage risk

Learn about our approach to managing environmental, social and governance risk.

Responsible lending

Our customer-related ESG risk policies incorporate consideration of ESG risk, regulatory requirements and voluntary commitments.

Responsible investment

Our wealth businesses have responsible investment policies.

Climate risk disclosure

From 2026, we are preparing for the introduction of the Australian Sustainability Reporting Standards - AASB S2 Climate-related Disclosures.

Why managing ESG risk is important

Risk exists in every aspect of our business and throughout the environments in which we operate. Our capabilities in risk management help us successfully implement our strategic priorities and develop a resilient and sustainable business that can respond to a constantly changing environment.

How we manage ESG risk

The Group takes a risk-based approach to managing ESG risk issues.

Managing ESG risk is part of our day-to-day business and it is identified, measured, monitored, reported and overseen in accordance with the Group’s Risk Management Strategy and Framework and reflected in the Group Risk Appetite Statement (RAS) and relevant supporting policies and management practices.

To help our employees better understand ESG risk, we include ESG risk content in our annual risk awareness training.

For further information:

- Download a copy of our ESG Risk Principles (PDF, 313KB).

- Read more on our approach to risk management.

- Read about our Supply Chain Management for information on how we manage risk in spending (our purchasing decisions).

- See our approach to human rights, and read our most recent and past Modern Slavery Statements.

ESG Risk policy settings

We maintain a High Risk ESG Sectors and Sensitive Areas list to help our bankers and procurement professionals know which sectors and activities may have a higher inherent exposure to ESG-related risks. It also sets out sectors and activities where we have restricted or no risk appetite. This includes the nuclear industry, arms-dealing and predatory financing. This list is reviewed annually and updated where appropriate to address emerging and changing ESG risks.

Additionally, NAB has disclosed the following customer-related ESG risk policy settings:

-

NAB has customer-related ESG policies and risk settings for a range of sectors which provide qualitative risk appetite descriptions and quantitative tolerances or limits with respect to what the Group will and will not finance to assist in managing climate risk. They operate alongside our interim sector decarbonisation targets, set out in the 'Metrics and targets' section of the 2025 Climate Report (PDF, 12MB).

NAB will consider national energy security in relation to the financing of power generation and gas (including gas infrastructure) sectors. Any such decision will take account of a range of factors and be made by relevant members of the Executive Leadership team. These factors include any relevant Australian government or regulatory reports or determinations (including from the Australian Energy Market Operator), together with the needs of domestic businesses (including industrial and manufacturing businesses) for stable, reliable and affordable energy.

ESG-related policy settings for coal, oil and gas are set out below.

Coal

- The Group has capped thermal coal (brown and black) mining EAD at 2019 levels, and set a goal to reduce thermal coal mining exposures by 50% by 2026, reducing to effectively zero by 2030 apart from residual performance guarantees to rehabilitate existing thermal coal mining assets.

- The Group will not finance new thermal coal mining projects or take on new-to-bank thermal coal mining customers.

- The Group will not provide new project finance for greenfield infrastructure connected to greenfield thermal coal mining projects.

- The Group will not support Capital Markets activities for thermal coal mining customers.

- The Group separately reports its thermal coal-related rehabilitation performance guarantees as part of reporting its resources exposures.

- The Group will not finance new or material expansions of coal-fired power generation facilities.

- The Group recognises that currently there are no readily available substitutes for the use of metallurgical coal in steel production. The Group will continue providing finance to its customers in this segment, subject to enhanced due diligence which further considers underlying ESG risks.

- The Group will not provide project finance for a greenfield metallurgical coal mine.

Oil and gas

- The Group has capped oil and gas EAD at USD $2.28 billion and will reduce our exposure from 2026 through to 2050, aligned to the IEA NZE 2050.

- The Group will not directly finance greenfield gas extraction, or expansion projects outside Australia.

- The Group will only consider directly financing greenfield gas extraction, or expansion in Australia where it plays a role in underpinning national energy security.

- The Group will continue to support existing integrated liquefied natural gas (LNG) in Australia and neighbouring countries and selected existing LNG infrastructure in other regions.

- The Group will not directly finance greenfield oil extraction, or expansion projects or onboard new customers with a predominant focus on oil extraction.

- The Group will not finance oil and gas extraction, production or pipeline projects within, or impacting, the Arctic National Wildlife Refuge area or any similar Antarctic Refuge.

- The Group will not directly finance oil/tar sands or ultra-deep-water oil and gas extraction projects.

- The Group will not directly finance new:

- Floating Production Storage and Offloading infrastructure.

- LNG liquefaction assets; and

- Transmission pipelines,

where these assets are dedicated solely to greenfield oil and gas extraction projects, unless they play a role in underpinning national energy security.

For lending exposure updates refer to page 69 of our 2025 Climate Report (PDF, 12MB).

For more detail on the actions we’re taking to help meet the goals of the Paris Agreement on climate change, while supporting security of energy supply in Australia and New Zealand, refer to our 2025 Annual Report (PDF, 18MB) and our 2025 Climate Report (PDF, 12MB).

-

Our approach to improper land acquisition is incorporated in our human rights approach and Group Human Rights Policy (PDF, 230KB).

We will not knowingly finance or provide advice to companies that have a prevailing conviction for improper land acquisition or against which we consider there is credible evidence of material violations of applicable laws and regulations.

We will review customer relationships where there is a risk of a customer operating outside the law or not meeting our requirements. If this risk is not addressed to our satisfaction, we may exit the banking relationship.

-

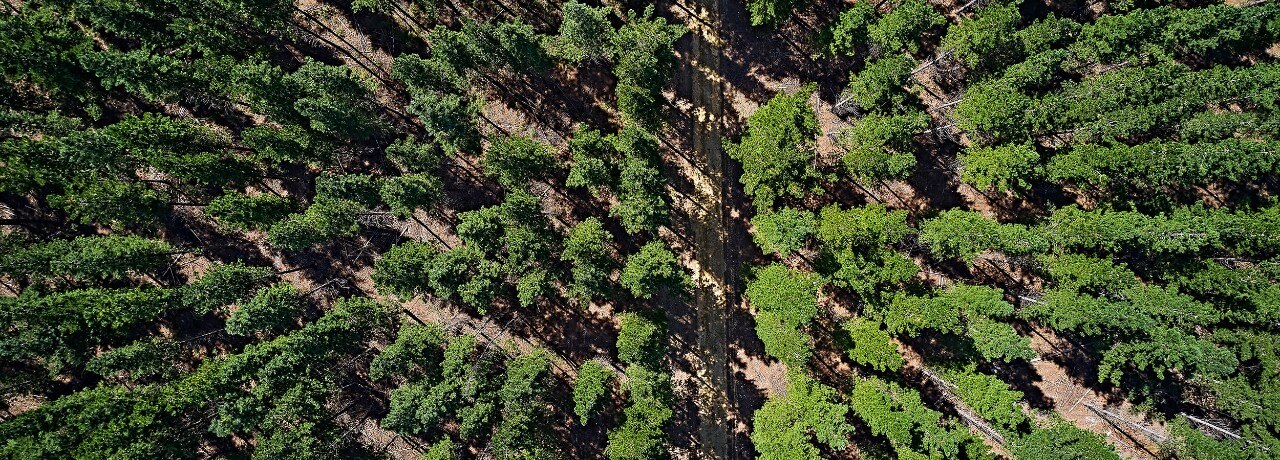

Deforestation and other forms of land clearing are a key threat to biodiversity which requires banks, governments, industry, and landholders to work together to develop solutions. It is one of the nature-related impacts identified in our preliminary portfolio assessment that effects industries such as agriculture, forestry, and energy and utilities.

If we become aware that customers are engaged in, or alleged to be involved in, land clearing without appropriate permits, approvals or exemptions (referred to as illegal land clearing), the matter is investigated. Action is taken, as appropriate, based on investigation outcomes, in line with risk appetite and NAB's ESG, Credit and Financial Crime policies and processes.

For more information, please refer to page 31 of NAB’s 2025 Annual Report (PDF, 18MB).

-

The Group has a set of Animal Welfare Principles (PDF, 312KB) to guide bankers in assessing customers’ animal welfare practices and to clarify the Group’s role in supporting customers engaged in any form of business involving animals.

The principles define good animal welfare practices and outline our expectations that customers will meet required animal welfare regulations, standards and conventions.

-

We are signatories to the Tobacco-Free Portfolio’s Finance Pledge, a global initiative to accelerate progress towards a tobacco-free future. As a signatory to the Pledge, we won’t provide finance for the purposes of growing tobacco or manufacturing tobacco-based products.

ESG risk in lending

The Group’s has three main areas of customer-related ESG policy and guidance to help bankers assess ESG risk as part of credit risk assessment and due diligence processes. These include: (i) general ESG risk associated with customers (for example – climate risk, nature-related risk, human rights including modern slavery risk and animal welfare), (ii) environmental contamination risk and (iii) Equator Principles.

The Group considers exposure to risk, including ESG risk, at a lending portfolio and individual customer level. The Group’s credit risk assessment and due diligence processes include the following steps, appropriate to the relevant sector, business activity and geography:

- Origination and internal review

- Evaluation

- Approval

- Documentation and settlement

- Customer engagement and monitoring

For more information refer to the Sustainability Risk Management section of our 2025 Annual Report (PDF, 18MB), which provides more detail on how ESG risk is incorporated in the credit risk assessment and due diligence process.

Our Business and Private bankers, as well as our Corporate and Institutional bankers, discuss environmental and social risks where relevant with their customers as part of their business relationships. This enables them to better identify and assess any risks that may arise on a case-by-case basis.

Environmental contamination risk assessments

Our bankers screen general credit applications to determine if NAB's customer-related environmental contamination risk policy should be applied. This is applied if the lending has the potential to involve environmental contamination risks due to:

- the nature of the industry in which the borrower is involved.

- the location or nature of the property owned by the borrower (for example, environmentally sensitive sites).

- an adverse comment made by a valuer in regard to an environmental contamination risk.

Where screening criteria triggers the need for environmental contamination risk assessment, bankers undertake an environmental contamination risk assessment as part of due diligence for a transaction. These assessments are reviewed regularly where material environmental contamination risks are identified.

Key elements of our environmental contamination risk assessment include understanding the:

- customer's current operations;

- environmental sensitivity and historical uses of a customer's site;

- customer's environmental practices, management systems and compliance records;

- risk of environmental liability transfer arising from customer's environmental contamination issues;

- nature of any licences, permissions or consents held by a customer;

- of any previous site investigations, environmental contamination surveys or audits; and

- community concerns in relation to the customer's operations.

Project-related finance and the Equator Principles

We became a signatory to the Equator Principles in 2007. This committed the Group to a voluntary set of standards for determining, assessing and managing environmental and social risk in project finance, project finance advisory and project-related corporate loans and bridge loans.

Equator Principles Version 4 (EP4 (PDF, 493KB)) came into effect on 1 October 2020. This included strengthened requirements in relation to human rights, revision of the approach to ‘Free Prior Informed Consent’, recognition of the Paris Agreement and introduction of a climate change risk assessment and a broadened scope in relation to project-related corporate loans.

NAB was an active participant in the EP4 development process.

Project-related finance assessment

When we assess opportunities for project-related finance within designated countries, we evaluate them for compliance with the relevant domestic regulatory requirements. Designated countries are those deemed to have robust environmental, social and governance regulatory systems and institutional capacity designed to protect their people and the natural environment.

In addition, for projects located in designated countries, the specific risks of projects are evaluated to determine if one or more of the International Finance Corporation (IFC) Performance Standards could be used as guidance to address those risks, in addition to host country laws.

For projects in all other countries (non-designated countries), we apply IFC and World Bank Environmental, Health and Safety Guidelines.

We apply these policies if there are concerns that a project may present a risk to areas such as ecosystems and biodiversity, including endangered species, and Indigenous peoples or community rights, in accordance with EP requirements.

Assessing project-related finance risk

We apply our Group Equator Principles Policy requirements to all relevant transactions. Our assessment and management of risk in project-related financing is based on independent expert due diligence, active risk management and the continual review of policies that are specifically applicable to project-related finance.

We also require customers who receive project-related finance to consider environmental and social compliance risks and, where applicable, encourage them to consider broader environmental and social risks, and to seek and follow relevant expert advice.

Equator Principles Reports

You can find our key Equator Principles statistics on the Equator Principles website.

Read our Equator Principles Reports in Performance and Reporting.

Responsible investment

Within the Group, JBWere conduct wealth related activities. JBWere’s Responsible Investment (RI) Policy (PDF, 2MB) and Responsible Investing Framework aim to provide clients with a comprehensive approach to investing for a dual goal: performance and purpose.

JBWere’s RIFframework spans ESG integration, stewardship of client capital, impact investing, and ethical filters and alignment. Collectively, these pillars align to globally recognised definitions of RI by the Global Sustainable Investment Alliance and reflect global best practice in private wealth.

Climate risk disclosure

Sustainable business is good business. It’s our responsibility to make good long-term decisions and help support a strong economy into the future. As part of this long-term approach, sustainability is embedded in our strategy, and includes priorities to tackle some of society’s biggest challenges where we are best-placed to make a positive impact, such as climate action.

Climate change and climate-related policy is having a growing impact on our business, our customers and the communities in which we operate. We have a key role to play in providing finance to assist the low carbon transition.

We’ve also developed knowledge and understanding of carbon measurement and management through our approach to reducing our own operational footprint through emissions avoidance and reduction, and offsetting residual emissions.

We recognise the growing demand for disclosure of information by financial institutions, including banks, to assist investors and other stakeholders to understand carbon risk in lending and investment portfolios.

We are:

- continuing to disclose climate risk information aligned to the Task Force on Climate-related Financial Disclosures recommendations in NAB Group’s half and full year results in FY25; and

- in FY26 preparing to report under the upcoming Australian Sustainability Reporting Standards – AASB S2 Climate-related Disclosures.

See climate change, our environmental approach and our 2025 annual reporting suite to find out more about actions we’re taking to deliver on our climate change strategy.

Information on our portfolio exposures is available in our Investor Briefings and Presentations.

Explore sustainability at NAB

Human rights approach

Upholding human rights is fundamental to the way we do business.

Sustainability approach

Learn how we’re embedding sustainability throughout our business.

Polices and approach

Browse our policies and resources.

Contact us

Use our Customer Support Tool

Solve problems quickly online with our easy-to-follow guides. Simply select a topic and we’ll direct you to the information you need.

Message us online

NAB Messaging is available to answer your questions in a secure environment.

- Log into NAB Internet Banking or the NAB app.

- Select the NAB Messaging icon.

- Select Start Conversation.

Stay in touch on social media

Connect with our social profiles online.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.