BPAY | Flexible and Simple Billing - NAB

Benefits and features

Benefits to you

- Manage your cash flow with no dishonoured cheques or payments.

- Payments processed before cut-off are available in your nominated account the next business day.

- Simplify your reconciliation. Receive daily account reporting to help track your payments.

- Reduce your costs by moving away from more costly payments channels such as cheques.

- Save on time and effort with the ability to assign Customer Reference Numbers that are unique to each bill or invoice, simplifying reconciliation of payments received. You can also control the date and amount of payment.

Benefits to your customers

- Greater flexibility means payments can be made anytime.

- Secure and respected payment system accessed within internet or telephone banking.

- Choice of paying by cheque, savings or credit.

- Some Billers will provide the ability to set up scheduled and recurring payments so bills are always paid on time.

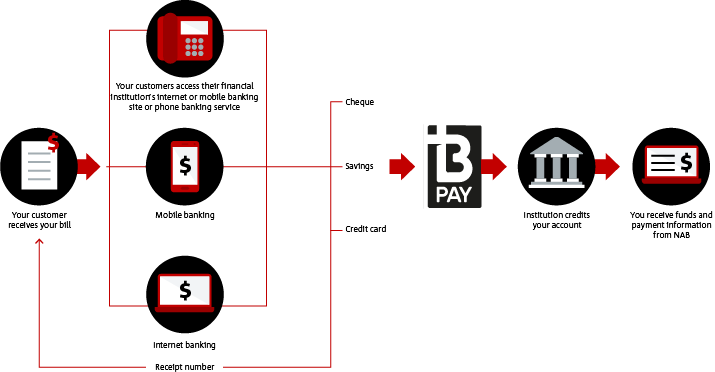

How does BPAY work?

BPAY is one of the easiest ways for you to collect payments and for your customers to pay you.

- Your customer receives your bill.

- The customer uses their bank’s internet, phone or mobile banking to pay their bill.

- They select from savings, cheque or credit account (if you decide to offer credit card payments).

- They select BPAY from payment options, pay their bill and receive a receipt.

- The customer’s financial institution credits your account.

- You receive the funds and the payment information from NAB.

Is BPAY suitable for your business?

BPAY may be suitable for businesses that:

- Send invoices either by email or mail

- Need to easily reconcile payments

- Use NAB Connect or Direct Link

- Have a NAB business account

Rates and fees

| Fee type | Fee amount |

|---|---|

| Biller Fees (once only establishment fee) or change of sponsorship | $99 (GST inclusive) for each biller code |

| Transaction fees | $0.88 (GST inclusive) for each transaction |

How to sign up

Step one

Enquire online or give us a call to discuss your needs.

Step two

We’ll have a chat about your business to see if BPAY is right for your needs.

Step three

You’ll work with one of our implementation team members.

Manage your BPAY

View and download important documents and tools you'll need to manage BPAY for your business, all in one place.

Talking shop

Business security hub

Keep your business and customer information safe with security tips to help prevent fraud.

Protecting your business online

Find out how you can reduce your risk with 3-D Secure.

Same day settlement

Make it easy for your customers to pay their bills with our range of billing solutions.

Preventing and handling chargebacks

Find out more about chargebacks and how to avoid them.

Related products

NAB Connect - Our award-winning platform

NAB Connect is a powerful online banking solution that gives you total control over your business.

NAB Direct Debit

Automatically collect payments from customers on time and in a cost effective way.

Transaction accounts

Access your money with our everyday bank accounts with no monthly account fee.

Contact us for merchant solutions and sales

Speak to a specialist for solutions, sales and enquiries.

Call us

Monday to Friday, 8:00am to 6:00pm (AEST/AEDT)

Within Australia: 1300 338 767

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

NAB BPAY Master Biller Agreement (PDF, 1MB)

NAB BPAY Biller Master Agreement Form effective October 2023 (PDF, 673KB)

NAB BPAY Biller Agreement (PDF, 634KB)

NAB BPAY Biller Agreement Form effective October 2023 (PDF, 496KB)

Business Banking Fees – A guide to fees and charges

BPAY® is registered to BPAY Pty Ltd ABN 69 079 137 518.