How to avoid paying credit card interest - NAB

What is credit card interest?

When you make purchases with your credit card, you’re essentially borrowing money from your bank or financial institution. Interest is a charge on that borrowed money. How much interest you’re charged depends on what type of credit card you have, what you spend money on, and when you make repayments. Learn more about how credit card interest is calculated.

Avoiding credit card interest

There are a number of ways to reduce the amount of credit card interest you pay or avoid paying it entirely.

Use your credit card’s interest-free period

Most of our credit cards have an interest-free period. Depending on your card, the interest-free period will be up to 44 days or up to 55 days.

To be clear, this doesn’t mean you get 44 or 55 days interest-free from the moment you buy something. The 44 or 55 days begins at the start of your statement period and ends at your statement due date. This is what we mean by 'up to'.

How your credit card interest-free period works

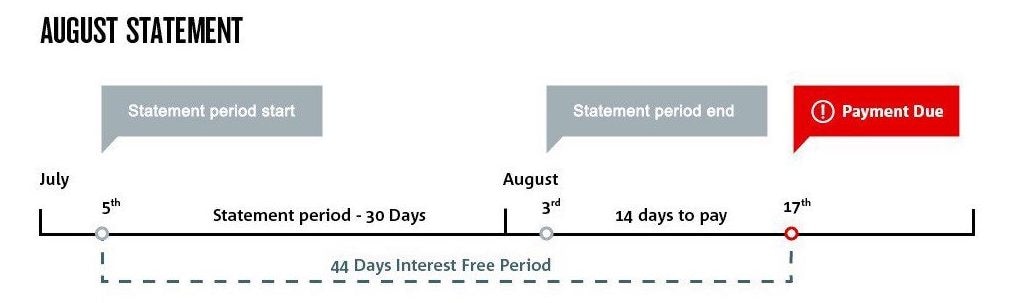

In this example, we're using an August credit card statement. Purchases on this statement would have been made during the statement period in July.

If the statement period begins on July 5, this is also the date that the 44 days interest-free period begins.

If the statement period ends on August 3, you then have 14 days, ending on August 17, as your ‘payment window’ to make a payment.

To avoid paying interest in this example, you would need to pay off the entire closing balance by August 17.

Transactions that don't have an interest-free period

- Cash advances: these are cash withdrawals made from your credit card account.

- Gambling transactions (these are considered cash advances). You can restrict gambling transactions in the NAB app.

- Purchasing traveller’s cheques or gift cards.

- Buying or loading value onto a prepaid or store-value card.

Avoid cash advances

A standard cash advance is withdrawing cash from your credit card. But since this isn't considered a purchase, interest-free days don’t apply. This means interest starts to add up from the moment you make the withdrawal.

Cash advances should be a last resort or in case of an emergency. If you need cash, it’s a way to get it if you’re stuck. But remember, the interest charged for cash is usually quite high, so try to pay it back as soon as possible.

Other examples of cash advances include:

- getting cash out from your credit card account at an ATM, or over the counter

- money transferred out of your credit card and into another account

- using your credit card for gambling

- bills paid with your credit card over the counter at another bank or at a post office (online bill payments are usually okay, but you should check with your biller first)

- traveller’s cheques or gift cards.

Pay off your 'closing balance'

The best way to avoid credit card interest is to pay off your closing balance before your statement’s due date. Your closing balance is the total amount you owe on your credit card at the end of the statement period.

If you pay this amount by the due date, or if your statement displays an interest-free days payment, you won't be charged any interest on your purchases. If you have a balance transfer, you'll need to pay the interest-free days payment shown on your statement.

Learn how to read your credit card statement.

Pay more than your minimum monthly repayment

If you can't afford to pay off your credit card in full each month, consider paying a little more than your monthly minimum repayment instead.

By paying a little extra each month, you’ll pay less interest. Check out the ASIC Repayment Calculator to see how much you can save by making higher repayments.

The thought of paying that little bit extra can be daunting. Learn how to set up a budget to help you stay on top of your expenses and work towards paying off your credit card balance in full.

Pay attention to special rates

If your credit card offers a special rate, pay attention to when it ends. The end date isn’t the last day you can make purchases at a special rate. It's the last day we’ll charge you the special rate.

For example. If a special rate ends 31 December, your closing balance will accrue higher interest from 1 January. This is regardless of any purchases before 31 December.

What happens if I don’t make my repayments?

You’ll be charged a late fee if you fail to make your minimum repayment. If you miss a repayment or don’t pay your closing balance in full, you’ll also lose the interest-free period on your credit card. That means interest will be charged on your unpaid balance from the day after the due date on your statement, until you repay the balance in full.

To restart the interest-free period on your credit card:

- Pay off the entire amount owing on your credit card to get interest-free purchases from that day.

- Pay off the closing balance on your statement to get interest-free purchases during your next statement period.

Here are some things to keep in mind if you’re struggling to make your credit card repayments:

Set up alerts and regular payments

If you think you’re likely to forget to make manual payments, why not set up a direct debit in NAB Internet Banking or the NAB app to pay it in full each month? Learn how to schedule and edit a recurring payment.

You can also set up an alert to be notified when you exceed your credit limit, to help you avoid overspending.

Learn more about paying your credit card.

Get in touch if you're facing hardship

We understand that life can take unexpected turns and leave you in a vulnerable financial position. If you're finding your credit card repayments difficult to make, we may be able to offer financial hardship assistance.

Explore other life moments

How is credit card interest calculated?

Learn how credit card interest is calculated and discover the ways you can avoid paying extra credit charges.

Common credit card fees and ways to avoid them

Understand the different types of fees and ways to avoid paying them.

Why you should avoid exceeding your credit card limit

Find out what happens if you go over your credit card limit.

Related products and services

Credit cards

Compare between our credit cards to find the right one for you.

NAB Now Pay Later

Make purchases online or in store with NAB Now Pay Later. Four easy instalments with no interest or fees.

Visa Debit cards

Access your own money wherever you are, however you bank.

Get in touch

Customer Support Tool

Solve problems quickly online with our easy-to-follow guides. Simply select a topic and we’ll direct you to the information you need.

Contact us

Explore our personal banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Visit us in person at your nearest NAB branch or business banking centre.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

BPAY® is registered to BPAY Pty Ltd ABN 69 079 137 518.

Credit cards issued by National Australia Bank Limited. © 2020 National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial and taxation advice before acting on any information in this article.