NAB Rewards Program | Earn and use NAB Rewards Points - NAB

Welcome to NAB Rewards

NAB Rewards is our loyalty program that lets you earn points every time you spend on a personal and business NAB Rewards credit card.

The points you earn with your credit card can be redeemed for rewards like flights, gift cards, tech and cashback in the NAB Rewards Store. You can also covert your points to partner programs like Velocity, KrisFlyer and Flybuys. NAB Rewards gives you the freedom to choose how you’re rewarded. Simply spend, earn and redeem your way.

How to earn NAB Rewards Points

You can earn points every time you use your NAB Rewards card on everyday purchases. There’s no cap on how many points you can earn.

Remember to redeem your points within 36 months so you don’t miss out on what the NAB Rewards Store has to offer.

NAB Rewards Points earn rates

Understand the value of your NAB Rewards Points, depending on which card you use for your everyday purchases.

Personal banking transactions that don’t earn points

Most everyday transactions on your NAB Rewards Platinum Card or NAB Rewards Signature Card earn points.

Transactions that don’t earn points include:

- cash advances

- bank charges and balance transfers

- buying foreign exchange or travellers cheques

- ATO payments

- BPAY® payments

- transactions where the cardholder uses a card to access linked transaction accounts

- transactions for gambling or gaming purposes.

For more information refer to the NAB Rewards terms and conditions.

How to check your NAB Rewards Points

You can check your NAB Rewards Points balance in the NAB app or NAB Internet Banking. Business customers can check their points balance in NAB Connect.

Read our simple step-by-step help guide to learn more.

How to redeem your points

Step 1

Visit the NAB Rewards Store

You can browse a wide range of rewards, including gift cards, cashback, travel, merchandise, charity donations and airline transfers.

Step 2

Redeem your points

Select your preferred reward and confirm the redemption. You can redeem with over 200 brands including Woolworths, JB Hi-Fi, Apple, Dyson, Samsung and many more.

If you have a NAB Rewards Business Signature Card you can also invest back into your business with rewards such as office supplies, training and employee recognition rewards.

Step 3

Set Up automatic redemption

In some cases you can choose to automatically transfer your points each month to partners like Flybuys, Velocity, or Accor Live Limitless.

Convert your NAB Rewards Points to Velocity Points

If you’re a Velocity Frequent Flyer member, you can convert your NAB Rewards Points to Velocity Points, to redeem when you fly with Virgin Australia or partner airlines, use eligible credit cards, shop with partner retailers, book hotels, hire cars and more.

Learn more about how to earn and redeem Velocity Points.

NAB Rewards Points Booster

Points Booster is a feature that helps you earn extra points faster. By shopping through the NAB Rewards Store or with participating retailers and partners, you can access special offers that multiply your points on eligible purchases.

To use Points Booster, log in to NAB Internet Banking or the NAB App, select your NAB Rewards card, and browse the Points Booster section for current deals. Complete purchases as outlined in the offer terms to earn extra points.

How Points Booster works

Learn how Points Booster works on different NAB Rewards cards.

-

- Bonus Points at eligible grocery stores: 1 NAB Rewards Point + 0.5 additional NAB Rewards Points (Bonus Points).

Eligibility for additional points at grocery stores is determined by a merchant’s Merchant Category Code (MCC). An eligible grocery store is a merchant whose MCC is designated as 5411 Grocery Stores. NAB is not responsible for designating MCCs and has no control over the same. You’re unable to get points if you use an intermediary platform such as PayPal or a delivery platform such as Uber Eats for these transactions.

- Bonus points with Webjet: 1 NAB Rewards Point + 1 additional NAB Rewards Point (Bonus Points). Purchases made online with Webjet via NAB Rewards Store or on webjet.com.au. Webjet Booking Terms and Conditions apply.

-

Bonus points with Webjet:

- When you spend under $15,000 on eligible purchases in a Rewards Statement period (calendar month): 1.5 NAB Rewards Points + 1.5 additional NAB Rewards Points (Bonus Points).

- When you spend over $15,000 on eligible purchases in a Rewards Statement period (calendar month): 0.5 NAB Rewards Points + 2.5 additional NAB Rewards Points (Bonus Points).

Purchases made online with Webjet via NAB Rewards Store or on webjet.com.au. Webjet Booking Terms and Conditions apply.

-

Double Points = your card’s standard point + an additional standard point (bonus point). Use your card to shop in-store and online at your favourite department stores and hardware stores. Choose from Myer, David Jones, Bunnings, Mitre 10 and many more.

Triple Points = Your card’s standard point + 2 additional standard points (bonus points)

- Overseas purchases: Purchases (in-store and online) where the merchant, financial institution or entity processing the transaction is located outside Australia, international transaction fees continue to apply.

- Webjet: purchases online with Webjet via NAB Rewards Store or on webjet.com.au. Webjet Booking Terms and Conditions apply.

Department and Hardware Stores: Applies to purchases made at major department and hardware stores (in store and online) including: Myer, David Jones, Kmart, Target, Big W, Bunnings, Mitre 10, Home Timber and Hardware, Stratco and Total Tools.

Overseas purchases: Purchases (in store and online) where the merchant, financial institution or entity processing the transaction is located outside Australia. International transaction fees continue to apply.

Webjet: Purchases made online with Webjet via the NAB Rewards Store or on webjet.com.au.

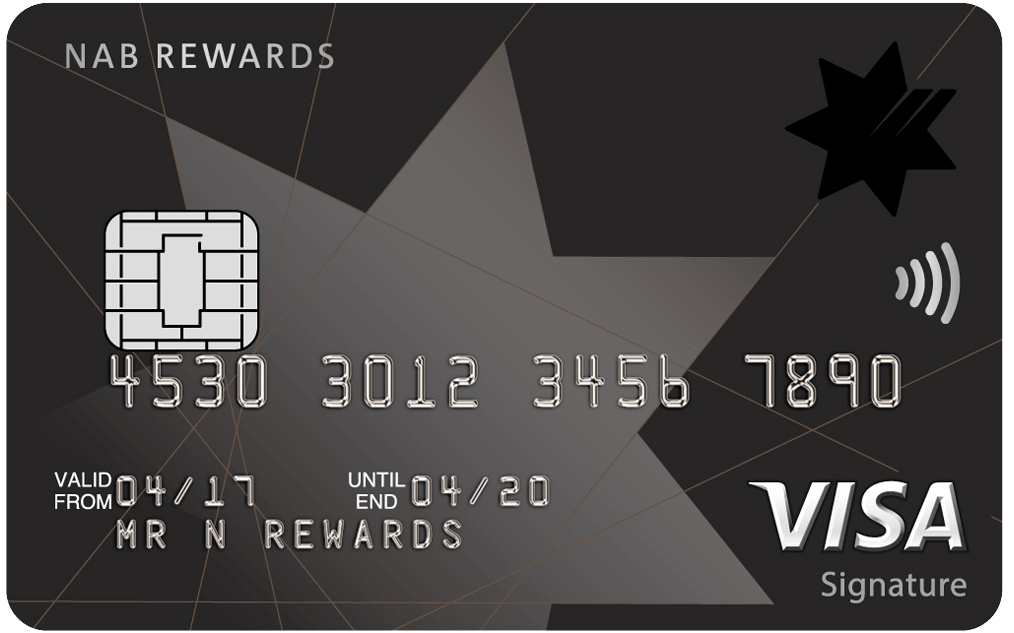

Explore NAB Rewards credit cards

NAB Rewards Platinum Credit Card

Redeem NAB Rewards Points for a wide range in our NAB Rewards Store. Plus, enjoy complimentary insurances and Personal Concierge.

NAB Rewards Signature Credit Card

Apply today to take advantage of earning bonus points and enjoying other great rewards.

NAB Rewards Business Signature Card

Earn NAB Reward Points and redeem them at the NAB Rewards Store for a range of products and experiences.

Get in touch

Visit a NAB branch

Visit your nearest NAB branch to speak to us in person.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Credit cards issued by National Australia Bank Limited.

BPAY® is registered to BPAY Pty Ltd ABN 69 079 137 518.