NAB Flex-Flow Loan | Merchant finance - NAB

Rates and loan amounts

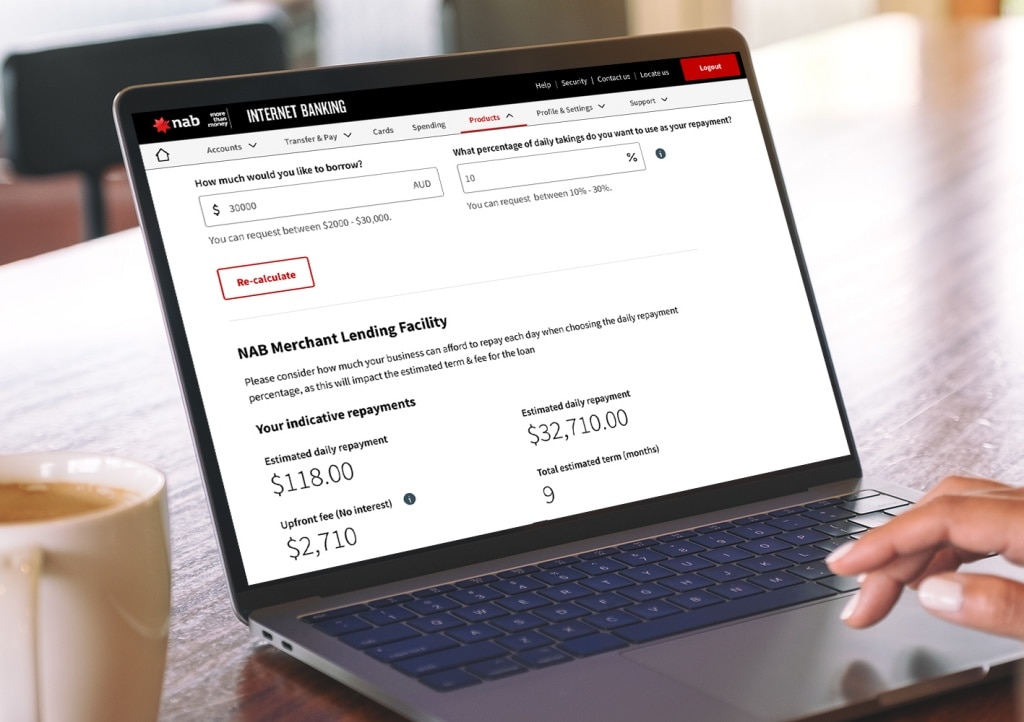

Check out the rates and minimum and maximum loan amounts of our merchant loan

Minimum loan

$2,000

Maximum loan

$125,000

Interest rate

0.00 % p.a.

Benefits of the NAB Flex-Flow Loan

Explore the benefits and features of our merchant finance loan and see how it can help your business.

Flexible repayments

Repayments change or ‘flex’ in line with your merchant sales activity. They are automatically calculated daily using an agreed percentage of merchant sales receipted each day. You choose a daily repayment percentage, between 10% and 30%, that suits your estimated cashflow. A minimum of 10% of the original loan value must be repaid every 90 days. You can make additional repayments at any time to pay down this loan faster.

One upfront fee, no interest

Enjoy the certainty of just one upfront fee which is added to the loan amount and no ongoing fees, charges or interest.

Quick decision, fast funds

Apply online in as little as 20 minutes and once approved, funds should be in your account within one business day after we receive your signed contract.

No assets for security

The strength of your business performance and your track record is all you need to apply - no physical assets are required to get the NAB Flex-Flow Loan.

Tailored loan term

The loan term is calculated based on your business data and will be unique to you. An estimated loan term takes into account the loan amount you choose, your historical sales and the repayment percentage you choose when completing the application.

Eligibility Eligibility and application requirements

Before applying check our eligibility and application requirements. All applications are subject to NAB credit assessment and approval. Terms and conditions, fees and charges apply.

If you are not a NAB merchant yet, learn more about our EFTPOS, payments and merchant solutions.

Getting started NAB Flex-Flow Loan application process

Help and support Common merchant loan questions

How do I repay the loan?

Loan repayments are automatically deducted daily from your merchant settlement account. The daily repayment amount is calculated as a percentage of your daily merchant sales, aligning your loan repayments to your actual cashflow. This means if sales are slow your repayments will be lower, and no repayment is deducted when you are closed or have no sales. You can select a payment percentage between 10% and 30% when you apply.

Can I change my repayment percentage or increase my loan value?

No. Once the loan contracts have been signed you cannot change the repayment percentage or increase your loan value. When you apply, make sure you select a repayment percentage that suits your cashflow.

However, you are able to make additional repayments to pay down the loan faster, but you will be unable to increase your loan or redraw once the loan has been established.

You might also be interested in

Get in touch

Request a call back

Complete our online appointment booking tool and a business banker will contact you

Contact us

Explore our business banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Let our business banking specialists help you in person.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.