PayID® for business - NAB

What is PayID?

Your PayID is a unique identifier linked to your business account and can be your email address, mobile number or ABN. Once you create a PayID, you can give it to customers instead of your BSB and account number to make paying and getting paid easier. In most cases, payments made using PayID are received almost instantly.

A better way to pay and get paid

Rather than wait hours or days for money to clear, payments made using PayID are received almost instantly. This makes it easier to know where your business stands financially.

Make paying easier for customers

Give customers your PayID instead of your BSB and account number to make it easier for them to pay you. They know their payments are going to the right place because your business name appears when they enter your PayID.

Improve your cashflow

Receive payments from customers and suppliers sooner and make payments on the due date to keep your money longer.

Fast payments

Payments made with PayID are sent and received through the Fast Payments system, in real time 24/7, in most instances within seconds. PayID doesn't replace your BSB or account number, it's just an easier alternative.

Easier bank reconciliation

You can create descriptions of up to 280 characters when making payments to accounts which have a PayID. This makes it easier to identify and categorise payments when doing your bank reconciliation.

Simple and secure payments

Reduce the risk of fraud or payments being sent to the wrong account, as you and customers can see the name of the person or business when paying.

Low cost

Easily take payments with no extra overhead and no need for an EFTPOS machine or a subscription to a payment service.

What you need to register your business for PayID

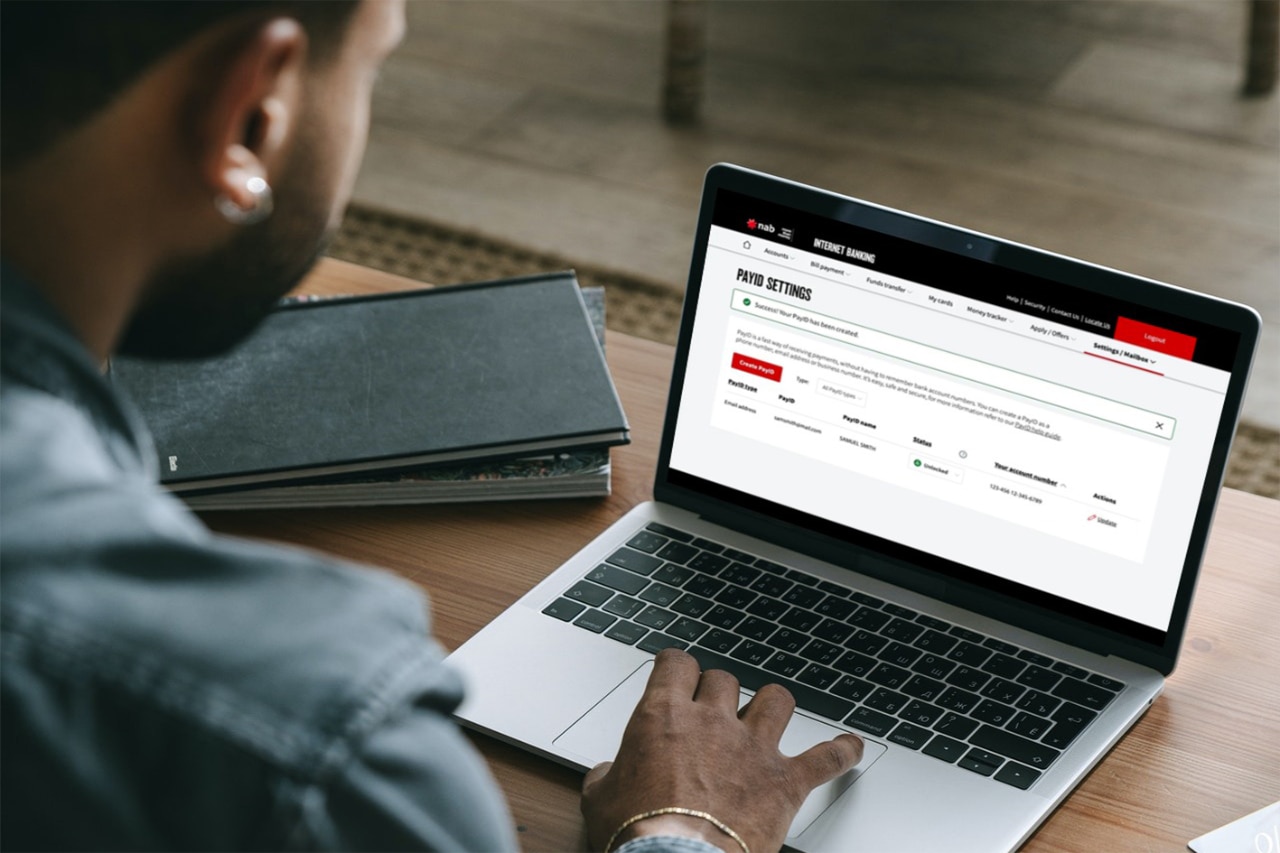

Create a PayID® in NAB Internet Banking and the NAB app

PayID is one of the fastest and most convenient ways to send and receive money. Learn how to create a PayID for your business.

Set up and update your PayID® in NAB Connect

Find out how to set up a PayID and update your PayID in NAB Connect.

Compare the payment options

PayID is a great way to pay and get paid through Fast Payments, but you still have other payment options with Overnight or Real Time Gross Settlement (RTGS) payments.

| Fast Payment | Overnight payment | RTGS payment | |

|---|---|---|---|

| Cut-off times | Fast Payment Payments are processed 24 hours a day, seven days a week. | Overnight payment 6pm for accounts at other financial institutions. | RTGS payment 3.50pm. |

| Timeliness of payment | Fast Payment Close to real-time. Funds are sent and received in under 60 seconds in most instances. | Overnight payment From a few hours to overnight or longer on weekends. | RTGS payment Usually less than two hours only available during business hours. |

| Payment confirmation | Fast Payment Real-time payment confirmation. | Overnight payment No payment confirmation. | RTGS payment No payment confirmation. |

| Information sent with the payment | Fast Payment 280 characters and remitter name and timestamp. | Overnight payment 18 characters and remitter name. | RTGS payment 140 characters and name and address of benficiary. |

PayID for business

Fast Payments FAQs

-

Fast Payments refers to all payments made on the New Payments Platform which includes Osko Payments.

-

Fast Payments are protected by NAB's real time transaction processing and monitoring capability and PayID is just as secure as how you bank now. Visit Security at NAB to learn more about how to stay safe online, including how to keep your internet devices secure.

-

Osko is the name of the payment service offered by BPAY®. NAB has signed up to Osko Payments.

With Osko Payments, funds are available in under 60 seconds and if you provide 280 characters of description text, the receiving party will see the full description.

You can make an Osko payment to a BSB and account number or a PayID, but both payer and payee accounts need to be enabled for Osko payments.

-

The NAB App

Open the Transfer & Pay menu and select Pay anyone, enter your details including a PayID (if available).

NAB Internet Banking (desktop)

Open the Transfer and Pay menu and select Pay to PayID and enter a PayID.

NAB Connect

If the payee and payer accounts are eligible, select Fast Payment under Payment method.

For transactions processed as a Fast Payment, you can use the detailed description field to enter and send up to 280 characters.

Note:

- If making a payment in NAB Internet Banking, Fast Payments is only available when paying to a PayID; if you're paying to a BSB and account number, cut-off times will continue to apply. Find out when cut-off times are.

- NAB and other participating financial institutions are currently rolling out Fast Payments to their customers, so you may experience a variability of service. A full list of participating banks is available on the New Payments Platform Australia's website.

-

No, you can make a Fast Payment to either a PayID or a BSB and account number.

To receive a Fast Payment, it can be sent to your PayId or BSB and account number.

Note: Other participating financial institutions may only allow Fast Payments if their customers pay to your PayID.

-

You can see a full list of participating banks on the New Payments Platform Australia's website.

-

On your receipt screen, we'll confirm the service used. Fast Payments generally occur in under 60 seconds.

If we won't be able to make your payment as a Fast Payment, we'll usually tell you at the time that you're making the payment.

In the NAB App, in instances where your Fast Payment cannot be made because the payee's account is not eligible to receive Fast Payments, we'll automatically resubmit it. When this happens, (depending on processing cut-off times) the payment will be processed overnight or the following business day. When this happens your payee will only receive the reference. If you haven't entered a reference, the first 18 characters of the description will be passed on to your payee.

Note: If your payment is time critical, you should always check your payment status.

-

You can check the status of your payment:

- in NAB Internet Banking by opening the Transfer & Pay menu and selecting Payment list.

- in the NAB App by opening the My Payments menu and selecting Past.

- in NAB Connect by checking the Payment Register.

-

The Reference field is used to tell payees what your payment is for - it's limited to 18 characters.

The description is a Fast Payments feature and can hold up to 280 characters. It lets you give your payee additional information to accompany a Fast Payment.

In the NAB app, if your payee's account is not eligible for Fast Payments, we will resubmit the payment as an overnight payment (cut-off times apply). When this happens, your payee will only receive the reference. If you haven't entered a reference, the first 18 characters of the description will be passed on to your payee.

For more information about Fast Payments, PayIDs and Osko payments, please refer to your eligible account Terms and Conditions or Business Product Terms and Conditions.

PayID for business FAQs

-

Only an account owner, or an authorised user who operates an eligible business account can create and update a PayID. You must also make sure that you’re logged in with your Business Primary NAB ID to register a new PayID, any third-party accounts linked to your personal NAB ID will not appear as an option.

-

Yes. Once you've created your PayID you'll be able to update it through NAB Internet Banking or NAB Connect. Note, you cannot update your PayID via the NAB Mobile Banking app.

You'll be able to:

- move your PayID between financial institutions by updating the status to 'Transfer'.

- update the PayID name that identifies your PayID. The PayID name must reflect your profile name and we provide you with a list of approved options. If you wish to update your profile name, please contact us as we will need to re-verify your identity.

- change the account your PayID is linked to.

- lock a PayID, so no payment can be received to the PayID.

- unlock a PayID that has previously been locked.

- close a PayID. A closed PayID can be linked to another account - within NAB or another financial institution. While closed, the PayID will not receive funds.

-

We perform an availability check when you create a PayID. If it's unavailable, it means it's already in use. If you think someone has created a PayID that belongs to you or your organisation, you can contact us to investigate.

-

No. All banks follow strict indentification steps to ensure a customer has the right to use a PayID and the account it's linked to. We'll verify ownership by sending a code to your email or mobile.

-

Yes, you can create more than one PayID for an account. However, you can't link a single PayID to multiple accounts.

-

Your PayID name can be viewed by anyone making a payment to your PayID. It's used during payment initiation to help confirm that the payment is being made to the correct PayID. When your business is making or receiving a payment via PayID, your bank account details, and personal information linked to your account are not disclosed. Rest assured, we'll keep your personl details secure, and your privacy continues to be managed within our privacy policy.

-

You can transfer or close your PayID through NAB Internet Banking or NAB Connect.

-

If your mobile number, email address or ABN changes you'll need to close the PayID as you may have lost the authority to use it. You can transfer or close your PayID through NAB Internet Banking or NAB Connect.

-

If you've made a payment to the wrong payee, you can lodge a transaction dispute. Learn more about how to dispute a transaction.

-

PayID payments are protected by our Fast Payments real time transaction processing and monitoring capability, and are just as secure and regular payments. Visit our Security Centre to learn more about how to stay safe online, including how to keep your Internet devices secure.

-

When you create a mobile PayID or make a payment to a mobile PayID, the mobile number is standardised to include the international code (+61). You can choose to quote your mobile number to customers with or without the international code.

Switch to new payment solutions

As Direct Credit and Direct Debit payments move away from the old Bulk Electronic Clearing System (BECS), we’re here to help you switch to our new, reliable payment solutions.

You might also be interested in

NAB Connect - Our award-winning platform

NAB Connect is a powerful online banking solution that gives you total control over your business.

EFTPOS, payments and merchant services

Find out how your business can take online payments with ease through our range of merchant products and services.

Billing and recurring payments

Make it easy for your customers to pay their bills with our range of billing solutions.

Contact us for all NAB online banking enquiries

Contact us

Contact us for NAB Connect and internet banking for business.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Further information about PayIDs and Fast Payments is available in the Terms and Conditions for your eligible account or Business Products Terms and Conditions.

PayID is a registered trademark of NPP Australia Limited.

BPAY® is registered to BPAY Pty Ltd ABN 69 079 137 518.