Keeping your assets in the family | family business succession - NAB

Understand the expected challenges

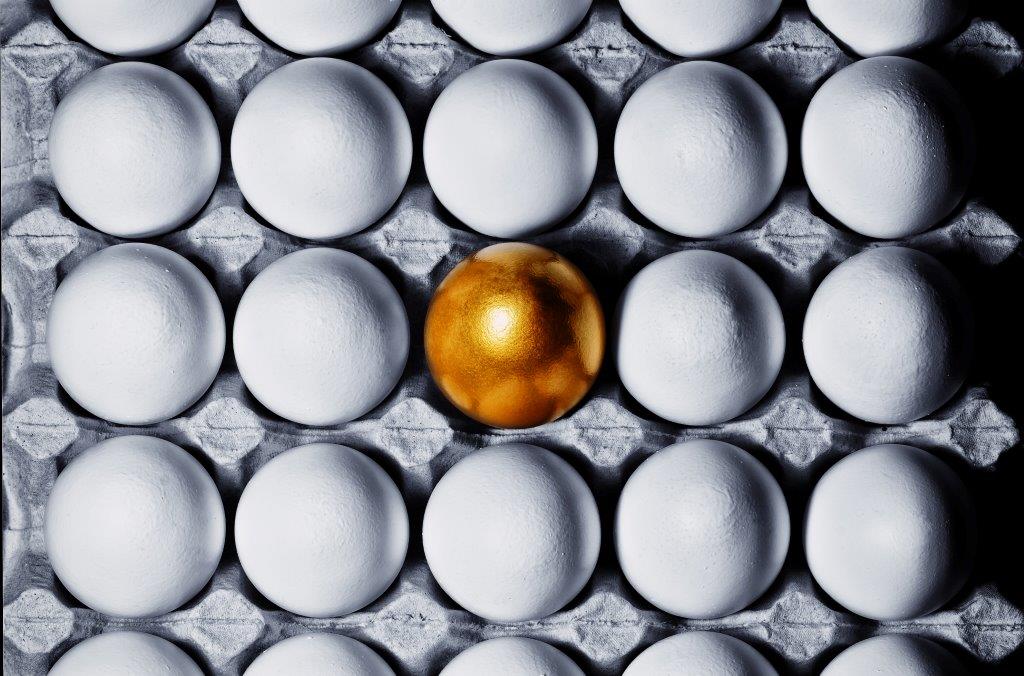

Family succession can be tough because it’s personal. There might be strong emotions and conflicting expectations to take into account. In addition, as families gain new generations and grow ever larger, it can be harder to cater to everyone’s needs and expectations. So how can you meet the challenge of passing on your assets, so that both your family and your business thrive?

1. Understand the number 1 reason for failure

One third of family businesses have not addressed succession planning. But, according to US authors Roy Williams & Vic Preisser, no less than 70 per cent of succession failures are down to just one thing – a lack of preparation.

The sooner you start planning your exit, the smoother your succession process is likely to be. Put it off and you could find that the people you’ve earmarked for critical roles don’t want the job after all. Or, if it’s left to chance, there may be no-one with the appropriate experience and business skills.

Then there’s the risk that unforeseen events could force you out of your business sooner than anticipated. Without a plan in place, your family could struggle to agree on who will own and manage the business and whether or not it should be sold. This can often lead to unnecessary conflict.

2. Recognise conflict is a killer

Communication is fundamental to succession planning, and that means discussing your intentions with everyone involved.

Some family meetings are entirely amicable. Others are less so, and if emotions run high, then you risk setbacks ranging from minor disagreements to walk-outs. As with any business meeting, conflict holds up proceedings, prevents agreement and calls the value of future meetings into question. And, according to future leaders who responded to KPMG’s survey, the number one cause of family conflict is poor communication style.

So spend time considering communication itself. There are ways to help a conversation run smoothly, such as setting out ground rules, giving everyone an opportunity to speak and encouraging full participation. But this isn’t always enough. You know your own family and if you think there’s a chance emotions will spill over, you might consider bringing in an impartial outsider. A business adviser experienced in the field should be able to identify different communication styles and build opportunities to connect, so you can all work as one towards your goals.

3. Embrace good governance for success

If communication is the first part of succession planning, then governance is the second.

A sound governance structure can support your business exit strategy or transition to retirement by setting out how decisions will be made. It can also encourage transparency, stability and family unity, and help preserve the family heritage over the long term.

A family agreement, also known as a constitution or charter, can take the vision, values and objectives of the family into account. It establishes rules for succession planning, communication and conflict resolution. It also clarifies the roles that various family members are expected to play and could also include your intentions for the future. For example, that you would like the family business to remain within the family for the benefit of multiple generations.

Most governance structures are implemented through a structural governing body. This could take the form of regular meetings attended by all members of the family. It could also be a representative family council – a decision-making committee of three and five members.

Some family businesses create a board of directors, and while it’s common for all of the directors to be family members, one or two trusted ‘outsiders’ such as an accountant or solicitor can help provide an impartial view. Others appoint an advisory board of independent experts who can expand their networks and provide ongoing professional advice. A board with independent directors can also exist in parallel with a family agreement, to help keep family and business matters completely separate.

Consider adding another expert

Whichever structure you choose, when you’re developing your transition to retirement strategy, you may want to include a dedicated wealth adviser in your team. This should be someone who can collaborate with your accountants and lawyers to help establish peace of mind for your family and, hopefully, financial security for generations to come.

Speak with a business banker

Let's talk - speak to your business banker or call us on 13 10 12.

Other business moments

Tips for entrepreneurs investing in the next big thing

A guide to angel groups and venture funding.

Charitable donations when exiting your business

Effective ways to donate proceeds from your business.

It’s never too soon to plan your business transition

Succession planning, begin sooner rather than later.

Related products and services

NAB Private Wealth

Learn about the benefits of private banking and why NAB Private Wealth might be right for you.

Trading and investments

Discover trading, investment and financial advice options to help you manage your wealth and plan for retirement.

Financial planning and advice

Get a strong partner supporting your business. NAB can refer you to an adviser from Bridges Financial Services or JBWere.

Get in touch

Contact us

Explore our business banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Our business bankers are located all around Australia.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial and taxation advice before acting on any information in this article.