Important terms and definitions for NAB Now Pay Later - NAB

-

As a digital-only product, you’ll get a digital card with your NAB Now Pay Later account. This allows you to pay in store through a digital wallet of your choice, or online with your card details. You can access your NAB Now Pay Later account through the NAB app. You can also view your NAB Now Pay Later account in NAB Internet Banking (but you can’t make any purchases through NAB Internet Banking).

These digital card electronic banking terms and conditions apply to the digital card issued with your NAB Now Pay Later account, as well as how you use the digital card for in store purchases at a contactless merchant terminal, or through electronic equipment, including online purchases. As these are EFT transactions, the ePayments Code applies (which NAB warrants to comply with).

12.1 Your digital card

When your NAB Now Pay Later account is set up, you’ll see your account and digital card in the NAB app, along with your digital card number, expiry and CVV. You can set a PIN for your digital card using the NAB app, which you might need for some merchant terminals if your purchases are above a certain amount (this is determined by the merchant terminal).

Keep in mind that NAB accepts no responsibility for restrictions on transaction amounts that need a PIN, or transaction fees imposed by merchants’ terminals. You may want to use your digital card up to the available spend, which you can view in your NAB Now Pay Later account when making a purchase. Your digital card automatically renews when it expires. You’ll still have the same card number, so that you can keep using it with your NAB Now Pay Later account and digital wallet.

Some online merchants may participate in a Visa updater service which will automatically renew the digital card expiry with a merchant, where the digital card details are with the merchant. Contact us via the chat function in the NAB app or NAB Internet Banking if you don’t want the Visa updater service to apply to your digital card.

12.2 Making purchases

Online purchases

For online purchases, your CVV number changes within an 8 to 24-hour period. Remember to check your CVV number when making online purchases. When you select an online transaction with your NAB Now Pay Later account within the NAB app, you’ll be prompted to include your card details and CVV number in the online merchant site to complete the purchase. Keep in mind that NAB accepts no responsibility for restrictions on purchase transactions online, or transaction fees imposed by online merchants.

In store purchases

You can make in store purchases on contactless merchant terminals using an electronic payment device (e.g., a smartphone, wearable, tablet or iPad) that’s enabled with Near Field Communication technology. You’ll need to enrol your digital card with a digital wallet of your choice and adhere to the terms of your provider. For some digital wallets, you may need to set a PIN, passcode or other authentication to get access to your wallet.

Keeping track of purchases

Make sure you keep electronic receipts for each purchase. This will help you identify the transaction details in your repayment plan and provide evidence of the EFT transaction charged to your NAB Now Pay Later account.

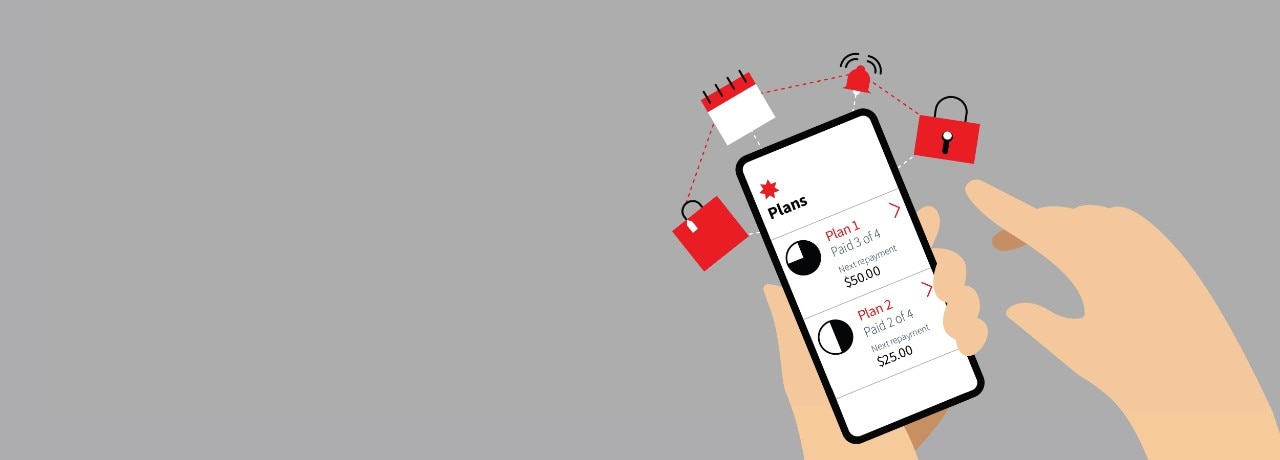

Before you make a contactless purchase, check that the correct amount is displayed on the reader or on the merchant terminal. You’ll be issued a separate repayment plan for each purchase made with your digital card and charged to your NAB Now Pay Later account.

You can find details of your purchase within the repayment plan, including the amount and date of the transaction, reflecting the date it is settled with the merchant’s financial institution and charged to your NAB Now Pay Later account (which may be later than the date on which you made the purchase).

You should regularly review your repayment plan details by checking your NAB Now Pay Later account in the NAB app. This means if you notice any discrepancies, errors or unauthorised transactions, you must let us know as soon as possible. If you want to dispute an EFT transaction, you must also report this to us. If your electronic payment device is lost or stolen or you notice unusual transactions, please see your contact options.

12.3 Safeguarding your digital card by protecting your electronic payment device

To protect your digital card it’s your responsibility to safeguard your electronic payment device from misuse, unauthorised access or from being lost or stolen. Such protection may reduce the possibility of any losses for unauthorised transactions on your NAB Now Pay Later account.

To do this you must:

- not share with anyone your electronic payment device or its passcode;

- not share with anyone any passcode required to access the NAB app on your electronic payment device or any digital card PIN or details of the digital card;

- ensure that any passcode used to lock your electronic payment device is not the same as:

- the passcode required to access the NAB app;

- any PIN for your digital card you set up using the NAB app;

- not allow another person to initiate an in store or online purchase using your digital card;

- not enrol your digital card to a digital wallet which another person may access;

- ensure you add your digital card to the digital wallet of the electronic payment devices only you have access to take reasonable care when using an EFTPOS terminal to ensure your digital card details and any PIN you use are not disclosed or visible to any other person;

- not make a record of the passcode required to access your electronic payment device or the NAB app or any digital card PIN on your electronic payment device which may be accessed or recognised by another person;

- keep your electronic payment device in a safe place, and provide reasonable protection for your electronic payment device from theft or misuse; or

- notify NAB if your electronic payment device is lost or stolen, or if the secrecy or security of your passcode used to access the electronic payment device or the NAB app or the PIN required to use the digital card is compromised See how to notify us.

These guidelines are for your assistance but your liability in the case of an actual loss will be determined in accordance with the ePayments Code.

Failure to meet these guidelines may in some circumstances constitute an act of extreme carelessness under this Section 12 which may mean you will incur liability for unauthorised transactions facilitated by such carelessness.

Your responsibilities and liabilities for the digital card

You are responsible for all EFT transactions authorised by use of the digital card with your NAB Now Pay Later account. Your liability may, however, be limited as provided below.

12.4 If you select a PIN for the digital card

Where NAB allows you to select a PIN or change your PIN for the digital card, you must not select a weak PIN, such as:

(a) a numeric code which represents your birth date;

(b) an alphabetical code which is a recognisable part of your name; or

(c) a code which is likely to be guessed by a person seeking to use the digital card without your permission.

If you select any of these, you will be liable for losses caused by unauthorised transactions performed using the weak PIN.

12.5 Liability for losses

You may not be liable in some circumstances

You will not be liable for losses:

(a) that are caused by the fraudulent or negligent conduct of NAB’s employees or agents or companies involved in networking arrangements or of merchants or of their agents or employees;

(b) arising because the digital card is faulty, blocked or cancelled independently of your actions;

(c) that are caused by the same EFT transaction being incorrectly charged more than once to your NAB Now Pay Later account;

(d) resulting from unauthorised transactions occurring after notification to NAB that your electronic payment device has been misused, lost or stolen or security of your electronic payment device, passcode or digital card PIN has been compromised; or

(e) resulting from unauthorised transactions where it is clear that you have not contributed to such losses.

Your liability for unauthorised transactions

You are liable for losses resulting from unauthorised transactions as provided below:

(a) where NAB can prove on the balance of probability that you contributed to the losses through your fraud or your contravention of the safeguarding requirements in this Section 12, you are liable for the actual losses which occur before NAB is notified that your electronic payment device has been misused, lost or stolen or that the security of your electronic payment device, passcode or digital card PIN has been compromised; and

(b) where NAB can prove on the balance of probability that you contributed to losses resulting from unauthorised transactions because you unreasonably delayed notifying NAB after becoming aware of the misuse, loss or theft of your electronic payment device, or that the security of your electronic payment device. passcode or digital card PIN has been compromised.

You will then be liable for the actual losses which occur between the time you became aware (or should reasonably have become aware in the case of a lost or stolen electronic payment device or that security of your electronic payment device, passcode or digital card PIN had been compromised) and when NAB was actually notified.

However, in relation to (a) and (b) above, you will not be liable for any of the following amounts:

(i) that portion of the losses incurred for any unauthorised transaction which exceeded the available spend for the transaction(s);

(ii) that portion of the total losses incurred on your NAB Now Pay Later account which exceeds the limit of your NAB Now Pay Later account.

(c) where a digital card PIN was required to perform the unauthorised transactions and neither paragraph (a) nor (b) applies, you are liable for the least of:

(i) $150;

(ii) the available balance of the NAB Now Pay Later account; or

(iii) the actual loss at the time NAB is notified (where relevant) that the electronic payment device has been misused, lost or stolen or that the security of your electronic payment device, passcode or digital card PIN has been compromised excluding that portion of the losses incurred for any unauthorised transaction which exceeds the available spend for the transaction(s).

12.6 When NAB’s electronic equipment fails

NAB will be liable to you for losses caused by the failure of NAB’s electronic equipment or system to complete an EFT transaction that’s accepted by NAB’s system or electronic equipment, in line with your instructions.

In this case, NAB’s responsibilities will be limited to correcting errors in your account and refunding you any imposed charges or fees. NAB will also not be liable for any losses caused by the failure of NAB’s electronic equipment where NAB’s system or electronic equipment hadn’t accepted the EFT transaction.

-

We may change any of the terms of our agreement without creating a new agreement. However, we will not change any terms that apply to your active repayment plans. Only repayment plans entered into after a notified change begins will be affected.

We’ll tell you about these changes by one of the methods we use for communication, unless we're not required to by law or relevant industry code. The below table outlines any changes we may make, and whether you’ll be notified and when. You’re free to close your NAB Now Pay Later account if you’re not happy with any change. You can do this by following these steps.

Type of change When you'll be notified Changes to repayments (amount or frequency or time for repayment of, or a change in method of calculation of, repayments) At least 20 days before the change takes effect Introducing a new fee or charge At least 30 days before the change takes effect Change any other term of this agreement At least 30 days before the change takes effect Change to manage a material and immediate risk if it’s reasonable for us to do so; or there is a new or changed government charge in connection with this agreement If we do need to notify you, we may give you a shorter notice period than the period described elsewhere in this table (for example, reasonably promptly after the government notifies us of the new or changed government charge) If we reduce your obligations (with the exception of reducing your available spend). For example, if we extend the time to make a repayment If we do need to notify you, we will do at the time the change takes effect -

If you’d like us to resolve an issue

All feedback is good feedback – especially if it helps us to fix any issues our customers are having with any of our products.

You can lodge a complaint or share concerns with us:

- In person – by speaking with us at your local branch.

- Phone our call centre on 13 22 65.

Help us help you sooner

Please have any supporting documentation handy if you do contact us. Giving us as much information as possible can help us resolve things faster.

How long will it take?

Most issues are resolved within one business day – and almost always within five business days. If it’s taking longer than that, we’ll keep you regularly updated as we see everything through.

If you need to take things further

If you feel we haven’t properly resolved the issue, you can then contact our Customer Resolutions Team by:

- Calling them on 1800 152 015. They’re on-hand to help Monday to Friday, 8:00am to 7:00pm (AEST/AEDT).

- Completing an online feedback form at nab.com.au, sending us a secure message through NAB Internet Banking or emailing feedback@nab.com.au.

- Writing to us at: National Australia Bank, NAB Resolve, General Manager, Reply Paid 2870, Melbourne, VIC, 8060.

Need more options?

14.1 Our external dispute resolution scheme

If you still feel your issue hasn’t been resolved to your satisfaction, then you can raise your concern with NAB’s independent external dispute resolution provider, the Australian Financial Complaints Authority (AFCA).

Of course, as you’re a valued customer, we’d much rather try to resolve the issue together first.

In fact, AFCA will encourage you to resolve the issue with NAB before they start to investigate.

The Australian Financial Complaints Authority (AFCA) can be contacted at:

Telephone: 1800 931 678

Website: https://afca.org.au

Email: info@afca.org.au.

Postal address: Australian Financial Complaints Authority, GPO Box 3, Melbourne, VIC 3001.

-

NAB collects, handles and shares your personal information in accordance with our Privacy policy and Privacy Notification.

These documents are accessible when you apply for a NAB Now Pay Later account. They’re also accessible at nab.com.au/privacy and include NAB’s Credit Reporting policy as well as the credit bureaus we deal with.

In response to your consent at application we will conduct a credit check in your name with our credit bureau partners. You also agree to us obtaining personal information about you, including credit eligibility information, from credit bureaus. We use this information to assess your application, the limit offered and to administer credit that we provide to you, including in relation to the collection of overdue payments.

We may also exchange information with other credit providers about your credit arrangements, and to notify other credit providers (including via a credit bureau) of a default by you.

When a NAB Now Pay Later account is opened in your name, this product and your repayment information will appear in future credit bureau reporting.

Some other terms of our agreement

Some extra terms and conditions apply to your digital access and use of your NAB Now Pay Later account through electronic devices, and for making repayments from your linked account.

NAB Internet Banking terms and conditions apply when accessing your NAB Now Pay Later account through the NAB app and/or NAB Internet Banking. NAB Now Pay Later isn’t available through NAB Telephone Banking.

Your NAB Now Pay Later repayment amounts are charged to your linked NAB Classic Bank account (linked account) which is covered by its own terms and conditions, found at nab.com.au. Separate statements are issued for your linked account under those terms and conditions.

Sometimes we might ask some questions about your use of NAB Now Pay Later, including to verify transactions or meet our regulatory requirements. You agree that you’ll provide us with a response to these questions within any reasonably requested timeframe.

If these terms and conditions conflict with terms and conditions for the linked account, the linked account terms and conditions will prevail in relation to amounts charged to your linked account.

If law makes a term of this agreement illegal, void or unenforceable, you and we agree that the affected term will be read down so this does not occur. If this can’t be done, you and we agree that only the affected term is to be excluded and the rest of this agreement should not be affected.

If this agreement uses the terms ‘includes’, ‘including’, ‘for example’ or similar expressions, anything referred to after those words does not limit what else may be included.

We can’t be responsible for extra services offered by third parties which can be used with your account (for example, digital wallets) unless of course in a particular circumstance the law makes us responsible. Our agreement is governed by the laws of Victoria. Any court cases involving the contract can be held in courts of any State or Territory of Australia with jurisdiction. We’ll give any legal protections available to you in the State or Territory in which you live.

The Banking Code of Practice and ePayments code

We follow the banking industry’s Banking Code of Practice (previously known as the Code of Banking Practice).

It’s a voluntary code that provides safeguards and protections for customers, and in some areas set higher standards than the law. It also sets out the principles that will guide us in our decision making when providing services – including being fair, responsible and accountable in our dealings with you, and acting with honesty and integrity.

We also comply with the ePayments Code. This regulates electronic payments and limits customers’ liability for unauthorised transactions, so long as reasonable protections are taken to protect the account.

Both codes apply to this agreement. You can access a copy of them from our website nab.com.au or at any of our branches.

Our commitment to be fair

When we exercise a right or discretion under our agreement and any additional terms and conditions (like considering a request you make or deciding whether or not to do something), we’ll do it in a way that’s fair and reasonable. This includes when we make changes to the product or your NAB Now Pay Later account limit. We can take a range of things into account when exercising our rights and discretions. These can include:

- our legal obligations, industry codes and payment scheme rules and the expectations of our regulators;

- protecting our customers, staff our and systems and the personal information we hold;

- what you have told us about yourself and how you will use our products and services (including if it’s misleading, incorrect or you haven’t provided us with all of the information we reasonably need when asked);

- how our products and services are intended to be used (and how you have used them);

- our public statements, including those relating to protecting vulnerable persons, the environment or sustainability;

- community expectations and any adverse impact on our reputation;

- whether we need to take any action to protect you or another person from a potential fraud or scam; and

- risk management, including sanctions risk management.

How we define some important words

Word

Meaning

active plan

a plan for which scheduled repayments remain due and payable.

available spend

the amount available for a purchase using the NAB Now Pay Later account.

business day

a day unless that day is:

a. a Saturday or Sunday; or

b. a day gazetted as a public holiday throughout all of Australia. This will not include a day that is only a State, Territory or regional public holiday.

card details

your digital card number, expiry date and CVV which is visible within the NAB app.

closed plan

a plan that has been fully repaid or cancelled.

contactless purchase

a method of authorising purchases:

- by waving or tapping a card (which is capable of making a contactless purchase) in front of a contactless reader and without having to insert or swipe the card;

- when available, waving or tapping an eligible device (eg mobile phone device or wearable device) in front of a contactless reader to transmit linked card details using Near Field Communication and complying with any required contactless authentication method.

contactless reader

an electronic device at a merchant which can be used to make a contactless purchase.

digital card

digital card provisioned to you in the NAB app for use with the NAB Now Pay Later account.

due date

date on which a repayment amount is due.

electronic banking facility

each banking facility available through the Internet or by telephone from NAB and any other electronic banking facility advised to you by NAB from time to time, including contactless readers. gambling transaction

making a purchase in a gambling transaction or using money to lay a bet, including any form of gambling transaction with a casino, lottery operator, betting agency or an entity conducting any form of gambling business.

legitimate interests

a. our legitimate funding, business, risk management, prudential or security requirements; or

b. any other requirements that are reasonably necessary to protect us against a material risk that a monetary default will occur.

linked account

NAB Classic Banking Account linked to your NAB Now Pay Later account to which repayments are charged.

NAB Now Pay Later account

the account to which purchase transactions are charged.

NAB Now Pay Later account limit

amount beyond which purchase transactions cannot be initiated or authorised.

NAB Now Pay Later overview

the ‘screen’ within the NAB app which displays NAB Now Pay Later account information including available spend, active plans and closed plans.

our agreement or this agreement or your agreement with us

the agreement between you and us, which is comprised of this document and which may be amended from time to time as described in the section on changes we may make.

purchases or purchase transactions

the transactions described as purchase transactions under allowable use.

repayment amount

amount due for each scheduled repayment under an active repayment plan.

repayment plan

the amount and timing of the four equal repayments for a purchase transaction.

total repayment amount

all amounts owing under each active repayment plan.

us, we and NAB

National Australia Bank Limited ABN 12 004 044 937, Australian Credit Licence 230686 and any of our successors and assignees.

you and your

the person who holds the NAB Now Pay Later account which is linked to an eligible NAB transaction account in the same name. It also includes any successors or assigns.

Continue with another topic

How account limits and available spend work

Learn more about how your available spend and account limit work in NAB Now Pay Later.

What is NAB Now Pay Later?

Learn more about how NAB Now Pay Later works including which transactions are allowed, and how repayments work.

Resolve issues with NAB Now Pay Later

Learn what to do when circumstances change and how to manage and resolve issues with NAB Now Pay Later.

Contact us

Online support

Let us help you with your personal banking needs.

Message us online

NAB Messaging is available to answer your questions in a secure environment.

- Log into NAB Internet Banking or the NAB app.

- Select the NAB Messaging icon.

- Select Start Conversation.

Important information

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.