Managing home loan repayments with interest rate changes - NAB

How do interest rates affect your home loan?

Whether your rates and repayments change during the life of your loan will depend on the type of home loan you have.

What happens if you have a variable rate loan?

If you have a variable rate loan, your interest rate can move up or down. Variable interest rates change due to the many factors that impact our cost of funds. One of those factors is the official cash rate, which is set by the RBA.

View your interest rate

You can find your current interest rate that applies to your home loan under the Account details section of your home loan in the NAB app and NAB Internet Banking. Otherwise you can view your interest rate on your home loan statements, or contact us for more information.

View historical changes to your interest rate

You can see historical changes to your interest rates in your home loan statements under the transaction details, which can be downloaded in the NAB app and NAB Internet Banking, or get in touch with a banker for further assistance.

What happens to your repayment when interest rates increase?

Your minimum contracted repayment may change if your interest rate increases. This is to ensure you can still repay your loan within your remaining loan term. We will give you at least 30 days’ notice if there’s an increase to your minimum contracted repayment. We’ll send a letter in the mail or an email letting you know you’ve got a letter in NAB Internet Banking. Use this guide to learn how to view your letters in NAB Internet Banking.

If you have asked us to, we will automatically adjust your direct debit payments to match your minimum contracted repayment whenever it’s changed.

What happens to your repayment when interest rates decrease?

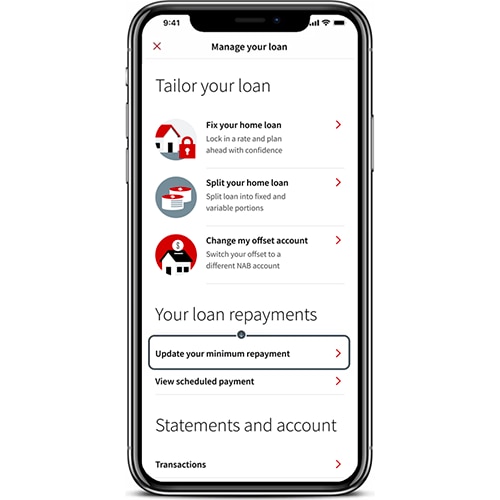

When interest rates decrease, your minimum contracted repayment on a principal and interest home loan will not automatically reduce. If you're eligible, you can update your minimum repayment using the NAB app:

1. Open the NAB app and select the home loan you want to update.

2. Tap the Manage button.

3. Choose Update your minimum repayment.

Alternatively, you can speak to a banker or start a conversation via NAB Messaging.

Important Consideration: You could have more money available in the short term by reducing the minimum repayment, but the trade-off is that you may pay more interest over the life of the loan.

Check your minimum instalment amount

You can find your minimum instalment amount that applies to your principal and interest home loan under the Repayments section of your home loan in the NAB app and NAB Internet Banking, or speaking to a banker.

What happens if you have a fixed rate loan?

If your home loan has a fixed interest rate, your minimum contracted repayment won’t change until the fixed term on your loan expires.

We’ll let you know when this is approaching and what your options are. In the meantime, you can use the tools and tips on this page to consider what your future repayments may be and any changes you can make to your spending habits now to prepare.

Updating your minimum repayment

If you're eligible, you can reduce your minimum repayment using the NAB app.

- Log into the NAB app and select your home loan account.

- Tap the Manage button.

- Scroll down and tap Update your minimum repayment.

- Tap Let’s start, follow the prompts and if you’re happy, tap Agree and submit the change.

- We’ll let you know when we’ve reduced your repayments.

- Ensure your repayment method is up to date.

Scenario planning for the future

It’s a good idea to see what your minimum repayment change could be over time if interest rates increase using scenario planning.

As an example, this table shows the impact of an interest rate rise with the extra cost per month based on a 30-year NAB Tailored Home Loan variable rate of 6.00% p.a. The change to a monthly minimum repayment depends on the size of the loan and the rate increase.

| Size of loan | Rate increase | Extra cost per month (estimate) |

|---|---|---|

| $500,000 | 0.25% p.a. | $81 |

| $500,000 | 0.50% p.a. | $163 |

| $500,000 | 1.00% p.a. | $329 |

| $500,000 | 2.00% p.a. | $671 |

Explore your repayments in different scenarios

To help with scenario planning you can use our home loan repayment calculator, starting with where you are at right now and explore scenarios.

Estimate your minimum home loan repayments

Follow our step-by-step guide to view your home loan account details and plan your future minimum repayments.

Home loan repayment calculator

Compare your loan amount with other factors to estimate your minimum loan repayments.

Ways to prepare for an increase in minimum contracted repayments

Review your current position

Consider reviewing your lifestyle expenses, budget and savings to see if you need to make changes and be ready to meet higher repayments.

Manage your NAB home loan

Use our calculators, guides and tools to help you manage your NAB home loan.

How to budget

Create a budget to help you meet your money goals.

Use a budget planner to help you save

Whether you’re saving up for a home loan deposit or wanting to reduce your debt, use our free budget planner to create a realistic budget to help you reach your financial goals.

Check if you’re ahead on your repayments

Variable rate loans come with the flexibility to make extra repayments and many of our customers have used this to pay ahead on their home loan.

You can find out if you’ve paid ahead by looking for your available redraw in the NAB app or NAB Internet Banking. The funds in your available redraw will be considered when we make changes to your minimum repayment amount. If you access your redraw, your minimum repayment amount may be impacted.

Self-manage your home loan

Depending on the type of loan you have, there are multiple ways you can manage your repayments, and many are available 24 hours a day, seven days a week.

-

If you’re sufficiently ahead of your loan and have surplus funds available on your home loan, you may want to use these funds as a buffer or for emergencies.

The amount you can redraw at a time depends on how far ahead you are of your scheduled repayments. There's usually a minimum and maximum amount you can redraw. It’s important to check how much you have available to redraw before you make any commitments.

-

Linking up to 10 offset accounts to your eligible variable rate home loan helps you pay off the loan faster. If you’re ahead on your home loan, it gives future options to talk to us about adjusting your minimum repayment amount. You can link your eligible NAB transaction accounts to an existing eligible home loan via the NAB app.

Fixing the interest on all or part of your loan can give a period of repayment certainty and if you split your loan between fixed and variable rate you will still have flexible features like offset available on your variable portion.

Think you might miss a home loan repayment?

If you’re in financial difficulty, please get in touch with us as soon as you can so we can discuss your options.

Contact us for home loan related queries

This is how you can get in touch.

Start a conversation with a banker

- Log into either NAB Internet Banking or the NAB app.

- Tap on the message icon.

- Type ‘speak to a person’ in the conversation window.

Call us

Speak to a home loan expert about a new or existing home loan.

Monday to Friday, 8:00am to 7:00pm (AEST/AEDT)

Saturday to Sunday, 9:00am to 6:00pm (AEST/AEDT)

Book an appointment

Make an appointment to see us at your nearest branch, ask a mobile banker to come to you or ask us to call you back.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

The information contained on this webpage is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial and taxation advice before acting on any information on this webpage.

Terms, conditions, fees, charges, eligibility criteria and lending criteria apply for all NAB products (available on request).

Correct as at 19 August 2022.