4.40 % p.a.

NAB Reward Saver | Bonus interest rate savings account - NAB

Maximise your savings with bonus interest

Earn bonus interest

Receive the variable bonus rate when you make at least one deposit on or before the second last banking day of the month and do not make any withdrawals during the month.

The sky’s the limit

Earn bonus interest on your entire balance with no limit.

Earn a bonus interest rate with no monthly account fee

Total interest rate

The total rate (variable base rate + variable bonus rate) you could earn if you meet the variable bonus rate conditions.

View our indicator rates for deposit products for full details.

Variable base rate | 0.01% p.a |

|---|---|

Variable bonus rate | 4.39% p.a |

Other account options to consider

Haven't found what you're looking for? Here are some other accounts to explore.

NAB iSaver

Enjoy flexibility with your savings while still earning interest. Receive the fixed bonus margin for the first four months on your first new account for balances up to $20m.

NAB Term Deposit

With a competitive interest rate for a term that suits you, our term deposits can help you reach your savings goals.

NAB Classic Banking account

However you bank, you’ll pay no monthly account fee. Spend more on what’s important to you.

Useful information

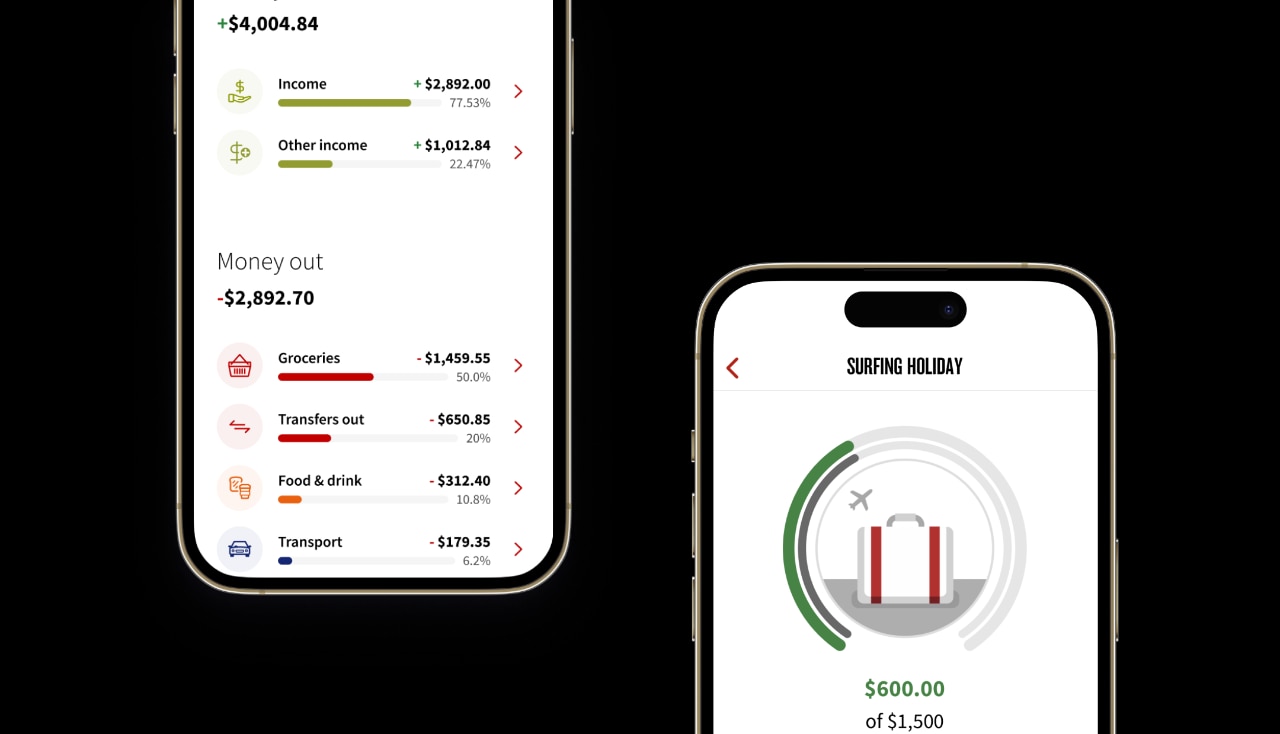

11 money saving tips to help you reach your goals

Read our simple tips you help you control your spending and save more money.

Budgeting tips | Create a savings plan

Create a budget to help you meet your money goals.

How to bucket your money and meet your savings goals

We give you some simple tips to help you budget better, control your spending and save more easily.

Help and support

Get in touch

Visit a NAB branch

Visit your nearest NAB branch to speak to us in person.

Important Information

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Any advice has been prepared without considering your objectives, financial situation or needs. Before acting on any advice, you should consider whether it is appropriate for your circumstances and view the Personal Transaction and Savings Accounts Terms and Conditions. Target Market Determinations for these products are available at nab.com.au/TMD. NAB products issued by NAB.

See our personal banking fees and charges and indicator rates for deposit products.

Closing your account

The quickest and easiest way to close your account is through NAB Messaging in Internet Banking or the NAB app.

If you need further support, please find your closest branch or give us a call on 13 22 65 or +61 3 8641 9083 if you’re overseas.