How it works | NAB Now Pay Later - NAB

Here’s how NAB Now Pay Later works

NAB Now Pay Later is our buy now pay later service. You’ll use your NAB Now Pay Later card when you want to split a purchase into four instalments.

When you sign up, you’ll choose one of your NAB accounts to link it to, and each instalment will come out of that account automatically every fortnight. You’ll also get a reminder before each instalment comes out.

When a NAB Now Pay Later account is opened, we need to report the new account to the credit bureau which would then appear on your credit file.

Transactions that are allowed

Most transactions for goods and services - including buying a fridge, paying for clothing or buying electronics - are considered purchases.

Transactions that aren't allowed

You can’t use NAB Now Pay Later for cash advances and gambling transactions.

Read our terms and conditions to learn more about what types of purchases you’re allowed to make with NAB Now Pay Later.

Shopping online

-

Log into the NAB app.

-

Select your NAB Now Pay Later account.

-

Check you have enough available spend to make the purchase.

-

Select Digital card to view your card details.

-

Copy your NAB Now Pay Later account details to pay at checkout.

-

Your new plan will appear in the NAB app under the Active payments menu on the Payments tab.

Shopping in store

-

Log into the NAB app.

-

Select your NAB Now Pay Later account.

-

Check you have enough available spend to make the purchase.

-

Open your digital wallet app and select your NAB Now Pay Later card.

-

Tap and pay with your NAB Now Pay Later card.

-

Your new plan will appear in the NAB app under the Active payments menu on the Payments tab.

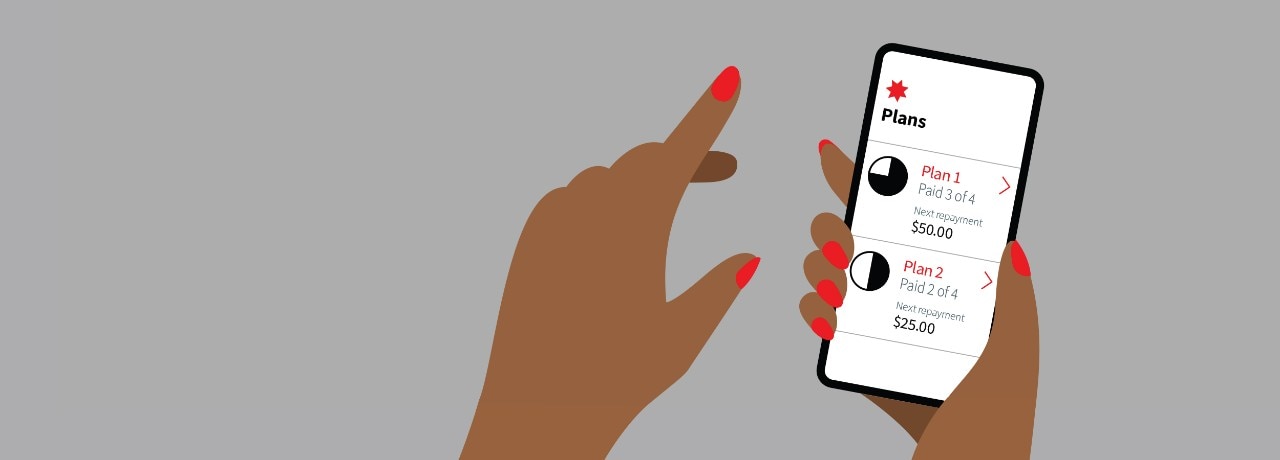

How repayments are charged

When you make a NAB Now Pay Later purchase, the amount charged to your NAB Now Pay Later account is the same as what’s shown on your receipt.

This amount is then split into four fortnightly repayments. Repayments are deducted from the linked account you select on sign up and scheduled over six weeks. We’ll automatically process your repayments each fortnight, but you can still make manual repayments in the NAB app if you’d like to pay early.

Read our terms and conditions to learn more about NAB Now Pay Later repayments.

How repayments are scheduled

The first repayment is charged to your linked account once your transaction appears in your NAB Now Pay Later account. The three remaining repayments are due each fortnight and deducted automatically. We’ll send you a notification the day before each repayment is due, so you can make sure you have enough funds in your linked account.

Remember, if a repayment can’t be completed because there aren’t enough funds in your linked account, the repayment will become overdue. Your NAB Now Pay Later account will be blocked to prevent you from making further purchases. However, we’ll contact you to let you know your repayment is overdue and that you’ll need to make a repayment on your account to unblock it.

That’s why it’s good to make sure you’ve got enough money in your linked account ready for each repayment, at least when you receive the reminder. This reduces the chance of a missed repayment. We’re required to report missed repayments to the credit bureau where they’re not made on time.

Read our terms and conditions to learn more about making repayments on time.

How to make a repayment

If you want to make a repayment before the due date, you have a couple of options.

Make an individual payment

-

Log into the NAB app.

-

Select your NAB Now Pay Later account.

-

Go to the Payments tab.

-

Choose the right plan.

-

Select Make a repayment.

Pay out a plan in full

-

Log into the NAB app.

-

Select your NAB Now Pay Later account.

-

Go to the Payments tab.

-

Choose the right plan.

-

Select Pay this plan and follow the prompts.

Pay multiple

-

Log into the NAB app.

-

Select your NAB Now Pay Later account.

-

Go to the Payments tab.

-

Choose the period from the Manage Repayments section.

-

Select Pay these repayments and follow the prompts.

We’ll charge your repayment to your linked account. You can make repayments early if you choose. Keep in mind that you can’t add funds to your NAB Now Pay Later account.

Find out more about making repayments or what to do if your account is blocked.

How refunds work

If you receive a refund on a NAB Now Pay Later purchase, we’ll credit it to your linked account at the end of the business day that we receive it from the merchant.

Keep in mind that refunds don’t automatically go towards paying off your active repayment plans. Your original repayment plan for the refunded purchase will remain active until you make the remaining repayments. You can use the refunded amount to pay off the plan early.

Let’s look at an example:

Sam purchases a pair of jeans for $100 on 14 July. He then returns this pair of jeans and receives a $100 refund credit on 22 July. We return the credit to his linked account. However, his repayment plan for the jeans is still active and has three more payments outstanding (a total of $75). Sam could use the refund he received to pay the total he owes on the repayment plan.

New to NAB

Start your NAB Now Pay later journey by opening a NAB Classic Banking account solely in your name.

Existing customers

Open the app to apply for NAB Now Pay Later now.

Make sure you have the NAB app downloaded on your device and it's up to date

Having trouble with the app link? If your app is up to date, just search 'NAB Now' in the NAB app to get started.

New to NAB

Start your NAB Now Pay Later journey by opening a no-fee NAB Classic Banking account solely in your name.

Get more help with NAB Now Pay Later

Make the most of NAB Now Pay Later.

Manage school expenses with NAB Now Pay Later

Learn how you can split school and university expenses into four simple repayments with buy now pay later.

Travel now, pay later with NAB

Find out how you can use NAB Now Pay Later for purchases when you’re travelling or on holiday.

Manage expenses with NAB Now Pay Later

NAB Now Pay Later is a buy now pay later account that can help split unexpected or large bills and expenses into four easy repayments, lessening the burden and stress of paying one upfront bill.

Contact us

Online support

Let us help you with your personal banking needs.

Message us online

NAB Messaging is available to answer your questions in a secure environment.

- Log into NAB Internet Banking or the NAB app.

- Select the NAB Messaging icon.

- Select Start Conversation.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Consider the NAB Internet Banking terms and conditions which apply when using NAB Internet Banking and the NAB app, before making any decisions regarding these services. The NAB app is compatible with Android™ and iOS, minimum platform requirements apply. Android is a trademark of Google LLC. iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license. Services issued by NAB.

Target Market Determinations for these products are available at nab.com.au/TMD.

Full terms and conditions will be available in the NAB app when applying for NAB Now Pay Later.