Business transaction accounts | Apply in under 10 minutes - NAB

Compare our transaction accounts

Find the right business bank account for your needs, whether you're a small or large business. Apply in as little as 10 minutes and enjoy online banking, accounting integration, ATM access and dedicated business support.

Most popular

NAB Business Everyday Account ($0 monthly fee)

Suited to businesses that mainly bank online, enjoy free electronic and ATM transactions with this everyday transaction account.

Ideal for businesses making a large number of cash and cheque transactions, enjoy 15 free eligible transactions every month.

Offer

Discounts and benefits for business transaction account holders

With a NAB business transaction account you can enjoy discounts and benefits from our partners.

Business account tools and calculators

Tools and calculators to help you decide on the right account and manage your business more easily.

Compare business bank accounts

Discover what business checking account is right for your business with our simple side-by-side comparison.

Business calculators

NAB has a range of business calculators and tools, along with a national network of business bankers to help you.

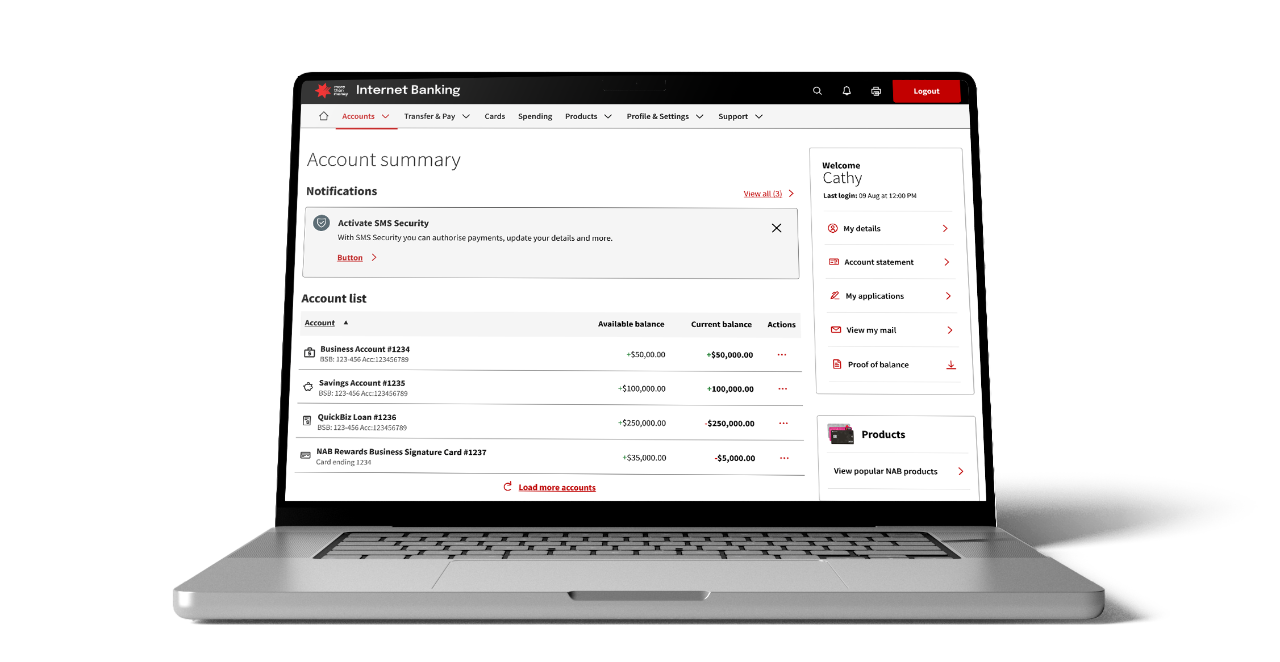

Manage your business finances easily with NAB Internet Banking

Other products to consider

Some other business products to help you run, grow and manage your business.

Business savings accounts

Savings and deposit accounts designed for businesses. They're easy to use and will help you make the most of your extra cash.

Specialised accounts

Our specialised business banking accounts are specifically tailored to your needs. Find the best business account for your unique banking requirements.

NAB EFTPOS machines

Our EFTPOS machines are ideal for fast, secure, and simple payments in-store or on the move.

Supporting young, fast growth businesses

“NAB’s business banking team is hands-on and helpful, responsive and knowledgeable.

When issues arise, they help us resolve them quickly.

They’re very like us in the way they do things: customer service and customer satisfaction are number one.”

Richard Li, co-founder

Help and support

We’re here to help. Use our guides and training to help you manage your business and banking.

Other ways we can help

Use our help guides, FAQs and other support services to help you manage your banking more easily.

Get in touch

Contact us

Explore our business banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Our business bankers are located all around Australia.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

NAB recommends you consider the Product Disclosure Statement or other disclosure document, available from NAB, before making any decisions regarding these products. These products are issued by National Australia Bank Limited ABN 12 004 044 937.

- Rates, fees and charges

- Business Banking Fees – A guide to fees and charges

- NAB Business Products Terms & Conditions

Any advice contained on this website has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice on this website, NAB recommends that you consider whether it is appropriate for your circumstances.

Target Market Determinations for these products are available at nab.com.au/TMD.