Dispute a transaction | Customer support - NAB

We’re here to help

If you see a transaction on your account that doesn’t look right, and you’ve tried to contact the merchant or recipient without being able to resolve the issue, you might be able to lodge a dispute.

How you raise a dispute depends on the type of transaction you’re querying.

There are common reasons you might need to dispute a transaction. For card transaction disputes, you might have not received goods or services, your card might have been charged twice for the same item, or you’ve been charged the wrong amount. For transfer disputes, you might have transferred money to the wrong account and can’t transfer it back.

Whatever’s wrong, we’re here to help. When you raise a dispute, we’ll start an investigation into that transaction to find out what’s happened.

How to dispute a card transaction

A card transaction is when you make a payment using your card details online, in-store at an EFTPOS machine, or with your digital wallet.

Before you dispute a card transaction

If you notice a card transaction that’s unfamiliar or incorrect, take these steps first:

- Check the transaction isn’t pending. See what to do for pending transactions.

- Confirm the transaction wasn’t made by another cardholder on the account.

- Search online to see if the unrecognised name is linked to a business you bought from.

- Check it’s not a purchase from a few days ago, as there can be delays between payment and the transaction appearing.

- Contact the merchant directly and try to resolve the issue. This is usually the fastest way to resolve a transaction dispute.

- Get more details about the transaction by logging into your other payment gateways like PayPal, App Store, Google Play, Shopify or Uber.

You can see the transaction and merchant details by selecting the transaction in NAB Internet Banking or the NAB app.

How to submit a card transaction dispute online

It only takes a few minutes to get the details of a transaction and then submit a dispute if you think something is wrong.

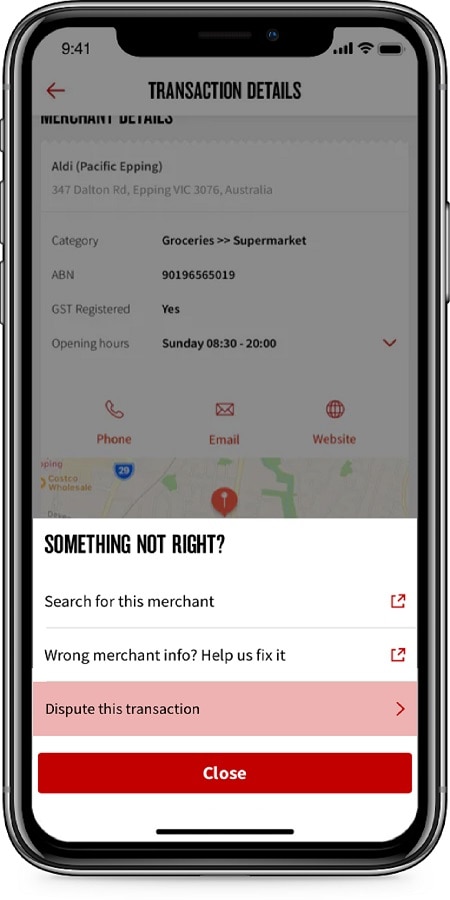

NAB app

-

Log into the NAB app.

-

Select the transaction.

-

Select Something not right? and follow the prompts.

For more detailed instructions see How to submit a transaction dispute.

Note, you'll need the latest version of the NAB app.

To follow up on the status of your card transaction dispute, see What happens once I’ve lodged a dispute.

Don’t have the NAB app yet?

The fastest and easiest way to dispute a card transaction is through the NAB app. You’ll need your NAB ID number which you can find on the back of your NAB card.

If your dispute relates to transactions other than cards, see how to dispute a transfer or other transactions (including international transfers).

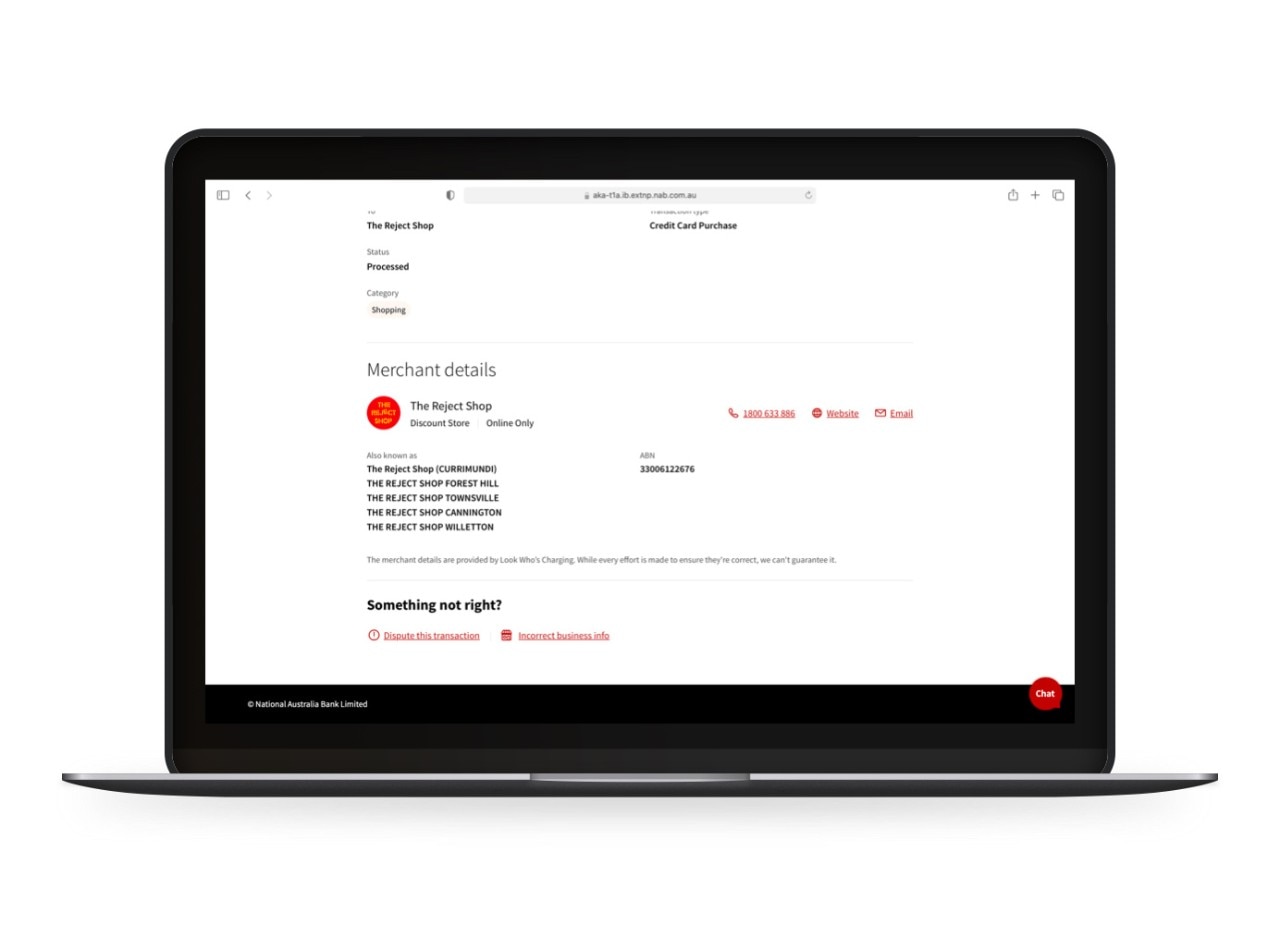

NAB Internet Banking

-

Log into NAB Internet Banking.

-

Select the transaction.

-

Under Something not right? select ‘Dispute this transaction’, and follow the prompts.

To follow up on the status of your card transaction dispute, see What happens once I’ve lodged a dispute.

Don’t have NAB Internet Banking yet?

It’s fast and easy to dispute a card transaction through NAB Internet Banking. You’ll need your NAB ID number which you can find on the back of your NAB card.

If your dispute relates to transactions other than cards, see how to dispute a transfer or other transactions (including international transfers).

How to dispute a transfer

A transfer is when you make a payment from your account to another BSB and account number, a PayID®, or a BPAY® biller.

Before you dispute a transfer

If you find a transfer in your transaction history that’s unfamiliar or incorrect, take these steps first:

- Check with any joint account holders to see if the transaction was made by them.

- Check where your funds were sent by heading to ‘My Payments’ in the NAB app or ‘Payment List’ in NAB Internet Banking.

- If you know the recipient, we recommend you try to resolve the issue with them directly. This will often provide the quickest resolution.

How to raise a transfer dispute

If you’ve made a transfer to the wrong BSB or account number, it may have gone to an invalid or incorrect account. If it went to an invalid account, it may take 2 to 3 days to return to your account. If funds have gone to an incorrect account or you are unsure, please contact us to raise a dispute. Please note that we can’t guarantee the recovery of funds that were transferred incorrectly.

If you or another account holder didn’t make the transfer and believe it’s a suspicious transaction, please contact us immediately so we can help.

If you’ve made a transfer from one of your NAB accounts to another NAB account accidently, for some products you can easily transfer between accounts to reverse the funds. If you’re unsure, please contact us for assistance.

How to dispute other transactions

- To dispute an ATM withdrawal, use the transaction dispute form.

- To dispute an ATM deposit, or a direct debit, please contact us.

- To dispute a NAB Purchasing and Corporate Card transaction, please download, complete and submit this form: Disputed transaction advice (PDF, 80KB).

- To dispute an international payment, message us securely by logging in to NAB Internet Banking or the NAB App. Learn more about NAB messaging.

How business customers can lodge a dispute

- To dispute a card transaction, business customers who have a NAB ID, also known as a NAB Identification Number (NIN), can lodge a dispute through NAB Internet Banking or the NAB app.

- To dispute other transactions or if business customers don’t have a NAB ID (for example, customers who use a Business Identification Number), use the transaction dispute form.

Note that using NAB Internet Banking or the NAB app is the most efficient way to resolve your dispute. Learn more about your NAB ID.

Learn more about lodging a dispute

-

You may see that a transaction is pending. This means it’s waiting for the payment to be processed by the merchant.

You can only submit a dispute once the transaction has processed, as we’ll only start investigating once the transaction is no longer pending. It usually takes 3 to 5 business days for a pending transaction to either fully process or drop off from your transaction history. In extreme circumstances this may take up to 10 business days.

-

Once you've submitted your dispute, we'll send you a reference number. We'll also keep you informed of your dispute's progress by email and contact you if we need more information.

If you've disputed a card transaction, you can also check your dispute's status anytime with NAB Messaging by following these steps:

- Log into the NAB app or Internet Banking

- Tap the messaging icon.

- Type ‘dispute status’.

- Our virtual assistant will find any disputes under your profile, or you can provide your dispute reference number.

- Select the dispute you’re interested in following up.

- You'll get a status update instantly.

More information on NAB Messaging.

-

We will try to resolve your dispute as quickly as possible:

- Card transaction disputes can take from several weeks up to 120 days to resolve.

- BPAY transactions can take up to 10 days to resolve, unless we require further information.

- Disputes about transfers within Australia, direct debits, EFTPOS transactions and ATMs can take up to 45 days to resolve.

- For disputes about international payments and transfers, we aim to respond promptly. But these can take longer than other transactions, particularly if more information is needed or there are delays by parties outside NAB.

-

If you or someone you know didn’t make the transaction or you believe it’s fraudulent, see how to report fraud and scams.

Help and support

Preventing debit and credit card fraud

Simple tips to keep your credit and debit card safe from fraud.

Report fraud and scams

How to identify fraud or a scam and how you can reach out to us to report fraud with our 24/7 fraud support.

How to identify spam and phishing messages

Be on the lookout for suspicious messages and avoid being a target of cyber-criminals.

Get in touch

Customer Support Tool

Solve problems quickly online with our easy-to-follow guides. Simply select a topic and we’ll direct you to the information you need.

Contact us

Explore our personal banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Visit us in person at your nearest NAB branch or business banking centre.

Interpreters available

Do you have limited English or prefer to speak in a language other than English? When you call us, just say “I need an interpreter” and we’ll arrange for someone to help with your enquiry.

If you don’t see your language listed, please ask us for help to find someone who speaks your language to help with your banking.

National Relay Service

If you’re d/Deaf or find it hard to hear or speak to hearing people on the phone, the National Relay Service can help. To contact NAB give our phone number 13 22 65 to the National Relay Service operator when asked.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

NAB App - NAB recommends you consider the Internet Banking terms and conditions document before making any decisions regarding this product. This product is issued by National Australia Bank Limited. The NAB Mobile Banking app is compatible with Android and iOS, minimum platform requirements apply.

Apple, iPhone, iPad, Touch ID, Face ID and the Apple logo are trademarks of Apple Inc., registered in the U.S and other countries. App Store is a service mark of Apple Inc.

Google Play and the Google Play Logo are registered trademarks of Google LLC.

iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license.

Android is a trademark of Google LLC.

BPAY® is registered to BPAY Pty Ltd ABN 69 079 137 518.

PayID is a registered trademark of NPP Australia Limited.

©2021 National Australia Bank Limited ABN 12 004 044 937, AFSL and Australian Credit Licence 230686.