More ways to grow your business | Tips to get you started - NAB

Discover more ways to grow your business

Foodie heaven - turning an idea into reality

How Harvest transformed into a destination dining experience.

Road from practitioner to designer

Caroline McCulloch shares the passion that drove her to create FRANKiE4.

Business growth in forestry draws investor billions

How a forester grew a $5 billion forestry asset management company.

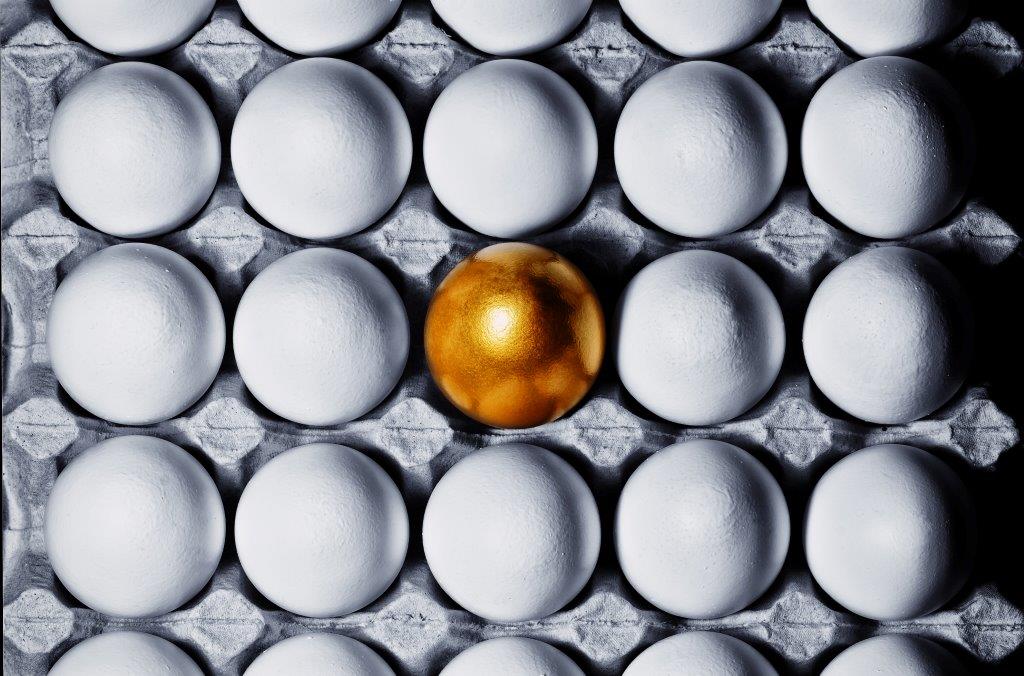

Give the extra 1% and watch business opportunities grow

What it takes to rise above the rest.

Time to diversify? Here are five ways to go about it

Diversification in your business can be key to profitable growth.

Five property investment tips for business owners

How to generate additional income streams to help grow your business.

For small business expansion, it's time to go digital

How embracing apps can help Australia’s small businesses expand.

Tips for entrepreneurs investing in the next big thing

A guide to angel groups and venture funding.

Tax time tips for small business

Our helpful tips take the hassle out of tax time.

Guide to managing business growth

Things to keep in mind as your business grows.

What you should know about a business restructure

A guide to managing business restructures.

Related products and tools

NAB QuickBiz unsecured business loan

Fast, unsecured business lending made easy. Get access to funds for your business without physical assets as security.

Business credit cards

Earn rewards points and manage business expenses with our range of business credit cards.

NAB QuickBiz unsecured business overdraft

Manage your cash flow and unexpected expenses with an unsecured business overdraft on your transaction account, up to $50,000.

Get in touch

Request a call back

Let us help with your business banking needs. Request a call back to chat with one of our business bankers.

Contact us

Explore our business banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Our business bankers are located all around Australia.

Important information

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial and taxation advice before acting on any information in this article.