Classic Banking account | $0 monthly account fee - NAB

Here’s what you get

$0 monthly account fee

Plus, no Australian transaction fee and no overdrawn fee.

An international transaction fee applies and debit interest may apply to overdrawn amounts.

Other fees and charges may apply. See our guide to fees and charges.

A rewarding bank account

Everyday banking just got sweeter. NAB Goodies gives you personalised cash back offers in the NAB app to enjoy every day.

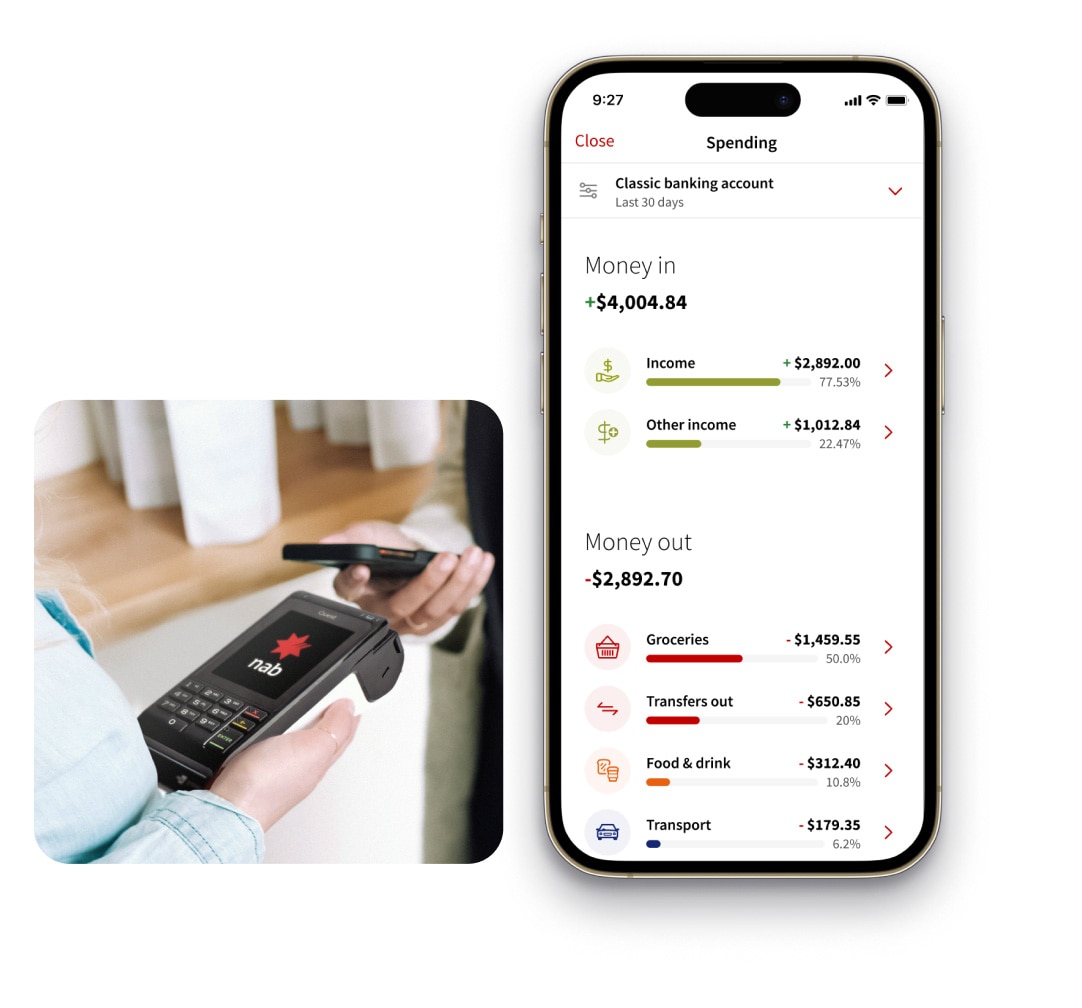

Digital wallet friendly

Easily add your new debit card to your digital wallet to start making payments.

Need a card?

Link your new bank account to your choice of two NAB Visa Debit cards. You'll be able to choose which card you'd like as part of your NAB Classic Banking account application.

Brands you could redeem with

Why you’ll love banking with NAB

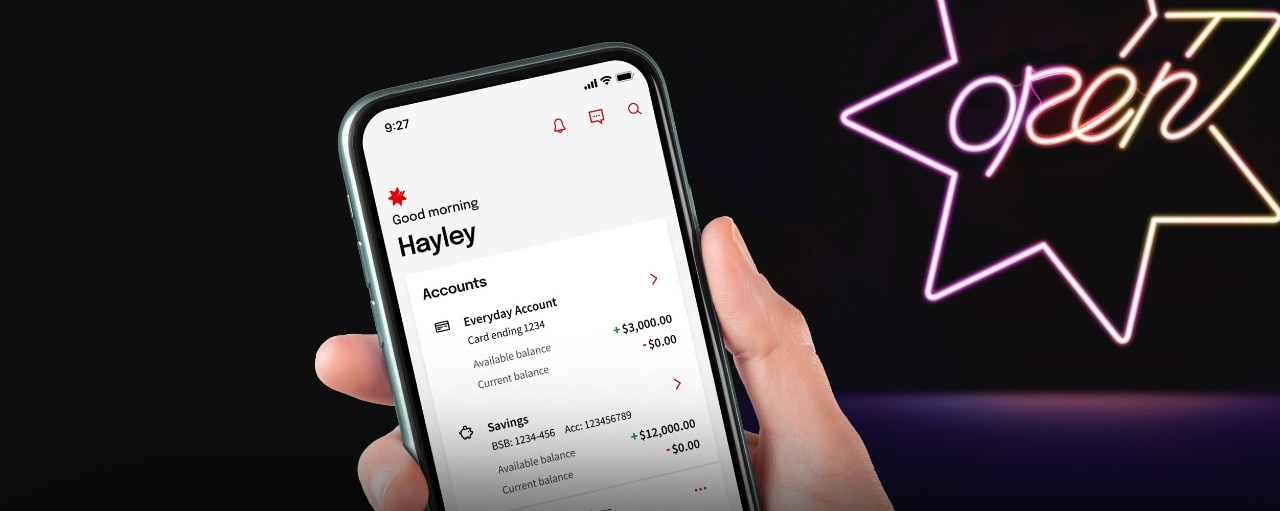

Open multiple accounts together

If you’re looking for a savings account too, save time by opening a NAB iSaver or NAB Reward Saver when you apply for your everyday account at no extra cost.

Simple money management

Use the NAB app to reach your saving goals and see the ins and out of your spending.

Security first

Enjoy peace of mind knowing that you can call us 24/7 if you think your account has been compromised.

Looking for something else?

Get in touch

Visit a NAB branch

Visit your nearest NAB branch to speak to us in person.

Important Information

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Any advice has been prepared without considering your objectives, financial situation or needs. Before acting on any advice, you should consider whether it is appropriate for your circumstances and view the Personal Transaction and Savings Accounts Terms and Conditions. Target Market Determinations for these products are available at nab.com.au/TMD. NAB products issued by NAB.

See our personal banking fees and charges and indicator rates for deposit products.

Closing your account

The quickest and easiest way to close your account is through NAB Messaging in Internet Banking or the NAB app.

If you need further support, please find your closest branch or give us a call on 13 22 65 or +61 3 8641 9083 if you’re overseas.