Internet banking | Register for online banking - NAB

Benefits of NAB Internet Banking

Banking online is quick, easy and secure. You can avoid the queues and do your banking anywhere, anytime. Here are just a few reasons to register today.

Manage your accounts in one place

Check your account balances and transaction history and if you don’t recognise a transaction, there's an option to get more information or dispute a transaction.

Enjoy safe and secure banking

Keeping your accounts secure is important to us. Find out about SMS security and what to do if you've been the victim of fraud or scams, learn how we're working to keep you safe, and ways that you can protect yourself from scams.

Bank anywhere, anytime

Enjoy the convenience of NAB Internet Banking on your desktop computer or tablet so you can complete everyday banking tasks quickly and easily.

Features of NAB Internet Banking

Here are just some of the great features NAB Internet Banking offers you.

Change your daily transfer limit

Set a daily transfer limit to Australian banks up to $100,000. The default limit is $2,500 if you’re not registered for SMS security or $5,000 if you’re registered for SMS security.

View and download online statements

View and download statements online. You can also get a proof of balance, interest statements and letters when you need them.

Transfer money overseas

Transfer your money securely overseas with online NAB international money transfers. Whenever you transfer money overseas in a foreign currency via NAB Internet Banking, your transfer fee will be $0.

How to register for Internet Banking

Before you can complete any banking tasks, you’ll need to register for NAB Internet Banking. Follow our simple guide to get registered.

View all online help guides

Learn how to do everyday banking tasks using your phone, tablet or desktop computer with our simple how-to guides. We show you how to register, set up a PayID® for faster payments, dispute a transaction online and much more.

What's new

Find the latest changes and improvements to NAB Internet Banking.

How to make the most of online banking

Make sure you're using all of the available online banking features and services we offer, including online statements, fast payments and our tool to help you track expenses.

Online account statements and letters

Explore the benefits of online access to your account statements, a proof of balance, interest statements and important letters.

PayID® is fast, simple and safe

PayID is the simple and faster way to send and receive online payments. Read our guide to learn more.

Track your expenses online with Spending

Our new tool to help you track your expenses through NAB Internet Banking.

Other banking services to consider

NAB Internet Banking for business

The simple solution for managing your business accounts, payments and financial data online.

Digital payments

Find out about our secure and convenient digital payment methods, including digital wallets and wearables.

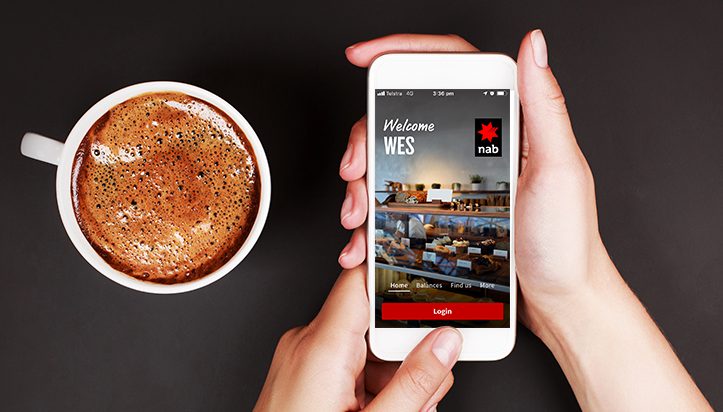

The NAB app

Manage your banking on the go with our mobile banking app for your smartphone or tablet.

Help and support

We have a range of useful guides and tools to help you manage your online banking.

Other ways we can help

Use our help guides, FAQs and other support services to help you manage your banking more easily.

Get in touch

Customer Support Tool

Solve problems quickly online with our easy-to-follow guides. Simply select a topic and we’ll direct you to the information you need.

Contact us

Explore our personal banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Visit us in person at your nearest NAB branch or business banking centre.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

NAB Internet Banking

Consider the Internet Banking terms and conditions which apply when using NAB Internet Banking and the NAB app. The NAB app is compatible with Android and iOS, minimum platform requirements apply. Android is a trademark of Google LLC. iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license.

App Store is a service mark of Apple Inc. Google Play and the Google Play Logo are registered trademarks of Google LLC.

PayID is a registered trademark of NPP Australia Limited ABN 68 601 428 737