Open multiple bank accounts - NAB

Benefits of opening more than one account

Manage your spending

With two or more transaction accounts, you can have one account for daily expenses and one for ‘fun', as an example. To make it easier to tell them apart, when you open a NAB transaction account you can choose a black or pink debit card.

Makes saving easier

It’s easier to save for specific things if you have multiple savings accounts. For example, you could have two or more separate savings accounts to save for house, a holiday or for emergencies.

Helps you bucket your money

Putting your money into separate transaction and savings accounts or ‘bucketing’ is a smart way to get ahead with your finances. Learn more at how to bucket your money.

How to open a new account with NAB

If you already bank with NAB, adding an extra account is simple.

Add an account via the NAB app

-

Login to the NAB app.

-

Tap on the more menu.

-

Tap on Product.

-

Select either Transaction account for regular expenses and spending or Savings accounts and follow the prompts to open the new account.

You’ll be able to choose either a black or pink card.

Repeat the above steps for each new account you set up.

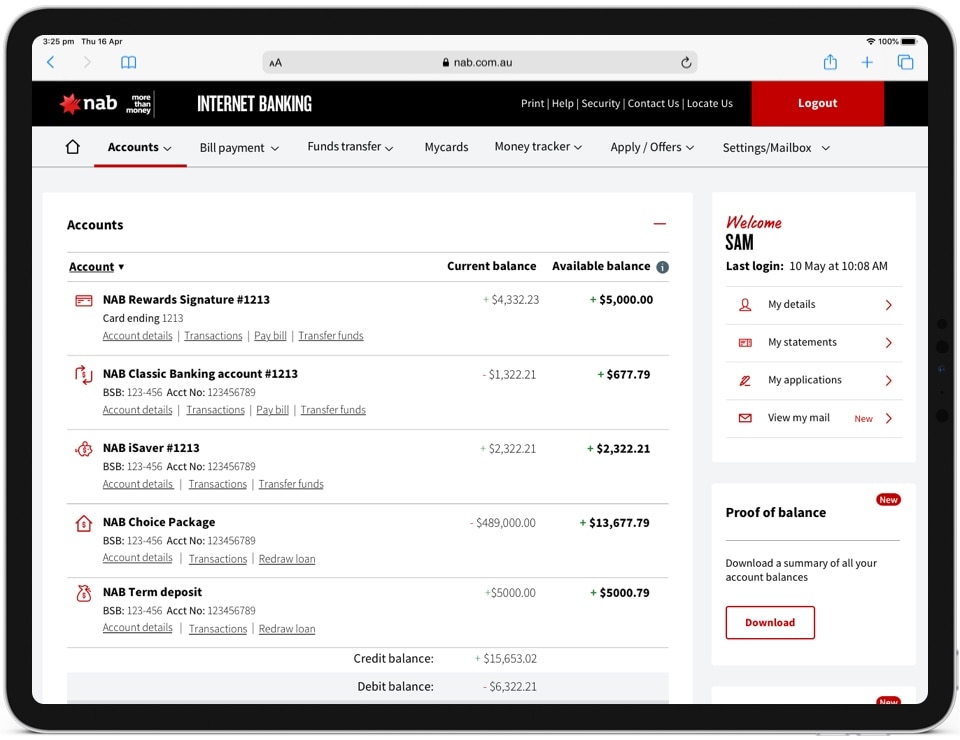

Add an account via Internet Banking

-

Login to NAB Internet Banking.

-

Go to Products then from the drop-down menu select Products.

-

Select either Transaction accounts for regular expenses and spending or Savings accounts and follow the prompts to open the new account.

Repeat the above steps for each new account you set up.

Don’t have a NAB account yet?

If you're looking for a savings account to help you get ahead, or a transaction account for your everyday needs, we've got you covered.

NAB Classic Banking account

However you bank, you’ll pay no monthly account fee. Spend more on what’s important to you.

NAB Reward Saver

Grow your savings faster with a higher interest rate, if you're a motivated saver.

NAB iSaver

Enjoy flexibility with your savings while still earning interest. Receive the fixed bonus margin for the first four months on your first new account for balances up to $20m.

Other options to consider

NAB Visa Debit card

Easy and secure access to your own money, wherever Visa is accepted.

NAB Platinum Visa Debit card

With additional benefits and features, this platinum debit card is your premium everyday card both at home and overseas.

Help and support

Use our guides and other resources to help you manage your money and banking.

Get in touch

Customer Support Tool

Solve problems quickly online with our easy-to-follow guides. Simply select a topic and we’ll direct you to the information you need.

Contact us

Explore our personal banking contact information and get support with a wide range of products, services and topics.

Visit a NAB branch

Visit us in person at your nearest NAB branch or business banking centre.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial and taxation advice before acting on any information in this article.

NAB App - NAB recommends you consider the Internet Banking terms and conditions document before making any decisions regarding this product. This product is issued by National Australia Bank Limited. The NAB Mobile Banking app is compatible with Android and iOS, minimum platform requirements apply.

Apple, iPhone, iPad, Touch ID, Face ID and the Apple logo are trademarks of Apple Inc., registered in the U.S and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play Logo are registered trademarks of Google LLC.

iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license.

Android is a trademark of Google LLC.

©2021 National Australia Bank Limited ABN 12 004 044 937, AFSL and Australian Credit Licence 230686.