4.40 % p.a.

Savings accounts | Compare accounts and interest rates - NAB

Compare our savings accounts

Whether you're saving for a goal or want easy access to your savings, we’ve got an account that may suit your needs.

Compare our account features and savings interest rates.

Grow your savings faster with bonus interest for regular deposits and no withdrawals.

Earn up to

Earn up to 4.40% p.a. (0.01% p.a. variable base rate + 4.39% p.a. variable bonus rate) for each month that you make at least one deposit on or before the second last banking day and no withdrawals.

View our indicator rates for deposit products for full details.

Is this savings account right for you?

Easily access your money with an online savings account linked to your NAB transaction account.

Introductory interest rate for 4 months

4.70 % p.a.

1.40% p.a. standard variable rate + 3.30% p.a. fixed bonus margin for 4 months. After 4 months, the standard variable rate of 1.40% p.a. will apply.

Fixed bonus margin is only available to customers who have not held a NAB iSaver in the last 12 months (on balances up to $20 million).

Is this savings account right for you?

Make the most of your savings

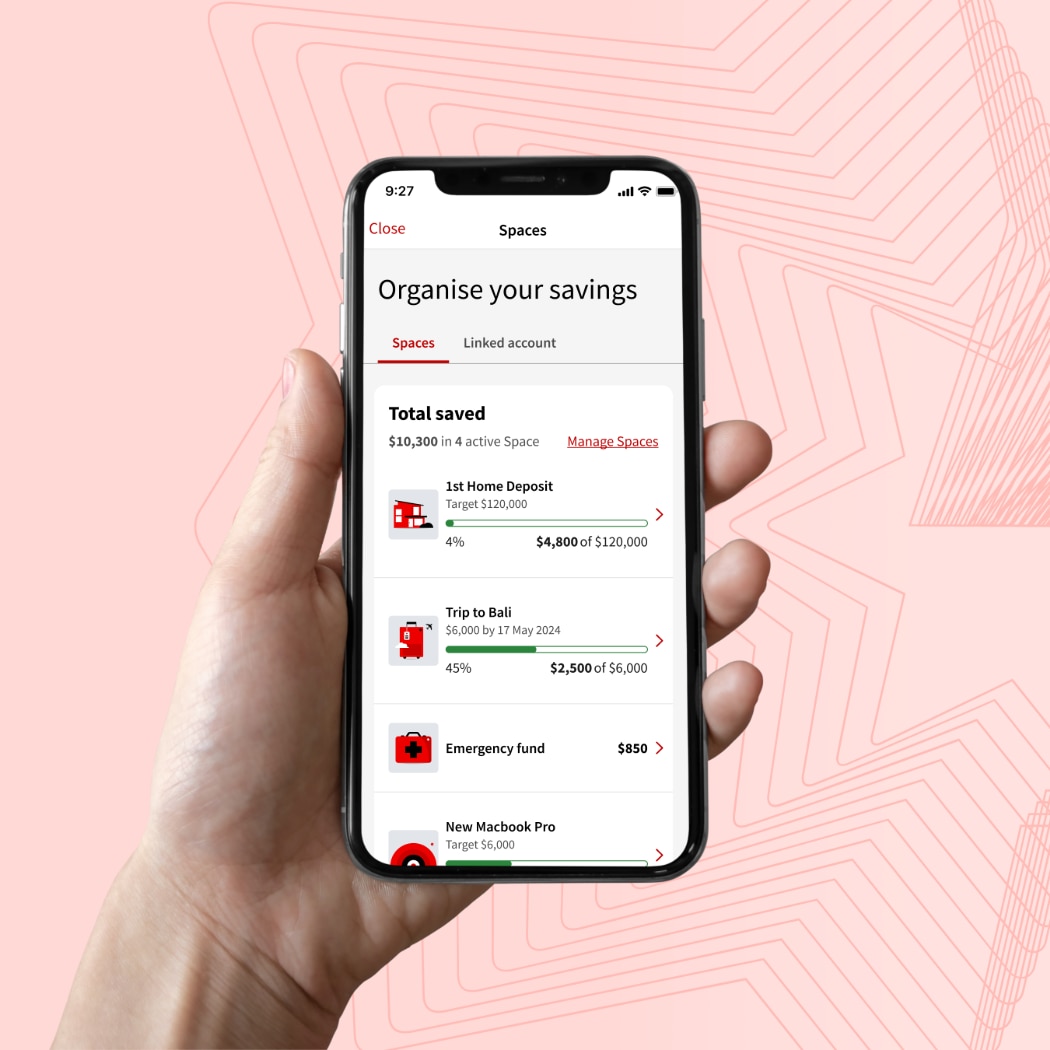

Set and track your savings goals

Create virtual savings jars with Saving Spaces in the NAB app, so you can save for all the things that matter to you.

Grow with confidence

Explore our Spending tool, designed to help you better manage your money.

Security first

24/7 secure access to your bank accounts with the NAB app – wherever you are.

Looking for something else?

NAB Term Deposit

With a competitive interest rate for a term that suits you, our term deposits can help you reach your savings goals.

NAB Classic Banking account

However you bank, you’ll pay no monthly account fee. Spend more on what’s important to you.

NAB Retirement Account

An everyday account for retirees. Earn interest and access your money with no monthly account fees.

Help and support

Guides and support services to help you manage your banking.

Get in touch

Visit a NAB branch

Visit your nearest NAB branch to speak to us in person.

Important Information

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Any advice has been prepared without your objectives, financial situation or needs. Before acting on any advice, you should consider whether it is appropriate for your circumstances and view our Personal Transaction and Savings Accounts Terms and Conditions and our Term Deposit Terms and Conditions. Target Market Determinations for NAB products are available at nab.com.au/TMD. NAB products issued by NAB. See our indicator rates for deposit products and term deposit indicator rates.

See our personal banking fees and charges and indicator rates for deposit products.